ByDaniel Aggre, Managing Director and Founder of Sikadvisory andAhmed Diallo (Financial Analyst)

After analyzing the different events that influenced the BRVM in 2017, les In this second part, experts discuss a sectoral reading of the BRVM as well as the decoding of the evolution of the companies that have been the stars throughout the year. The 3th part focuses, it, on the perspectives of the year 2018.

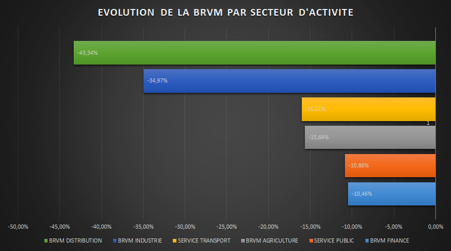

Evolution of the BRVM by sector of activity

BRVM Distribution: 43.34% decrease in 2017

Since the end of the post-electoral crisis in Côte d’Ivoire, it has been the second sector that has made the most progress at the BRVM. From 2011 to 2016, BRVM Distribution recorded a cumulative growth of 313.67%. Also at the date of 30 / 12 / 2016, BRVM Distribution had the highest price earning ratio (PER) of the BRVM, ie an average 33.03 PER.

On the other hand, companies in this sector distributed dividends [1] less important than the previous year to their shareholders. Let 20.42 billion FCFA in 2016 against 21.02 billion FCFA in 2015.

Hypothesis: Such a pricey PER already reflected a very high expectation of investors. Unfortunately the country’s security situation at the beginning of the year and the publication of dividends were perceived as a bad signal by investors who preferred to change their strategy and exit their positions.

BRVM INDUSTRY: 34.97% decrease in 2017

This is one of the least profitable sectors of the BRVM. And for good reason, the companies that compose it, are the ones that have suffered the most assault of competition these 7 last years. We can mention the case of SOLIBRA Vs BRASSIVOIRE. When it is not unfair competition through counterfeit and cheap imported products in the case of UNIWAX, UNILEVER or NESTLE.

It should be noted that five (5) companies on 11 covering this sector have announced a decrease in their net results when the 2017 half-yearly results are published.

Hypothesis : With five (5) companies in the same sector announcing downward results and very aggressive competitors, this sector has not provided enough evidence of stability to reassure investors. Especially in a year so hectic.

BRVM TRANSPORT: 15.99% decrease in 2017

Despite the good results of Bolloré (+ 38% of the net result in the third quarter), the stock has recorded a fall in the share price of nearly 16%. The security situation in the country has been a major factor for investors. These have anticipated a decline in the company’s activity by leaving rather their positions. Thus, Bolloré lost about 33% of the price of his action at 1er 2017 semester.

Port activity being strongly correlated with economic and political activity, the share price was hostage to the perception that investors had about the damage caused by social unrest on the company’s activity. Thus, the action BOLLORE seems to best reflect the psychology of investors throughout the year.

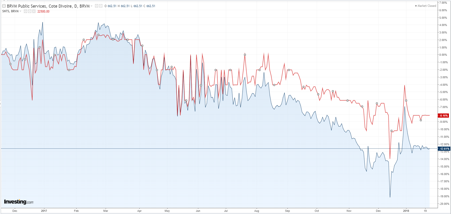

In a graphical representation (below), we will find that there is no difference between the BOLLORE share price and its index. Indeed, Bolloré is the flagship action that influences this sector, MOVIS having low transaction volume.

BRVM AGRICULTURE: 15.64% decrease in 2017

Agriculture has been one of the most resilient sectors of the BRVM with two (2) companies finishing in the green. This feat is mainly due to the soaring prices of the international market of rubber and palm oil. They constituted a bulwark with the downward trend of the BRVM.

Unfortunately this sector has been hit hard, the lack of visibility and communication of SICOR and SUCRIVOIRE. Indeed, since the publication of SICOR’s annual 2016 results, the company has not made any communication about its activities. Like SUCRIVOIRE, who suffered from a bad image since his OPV.

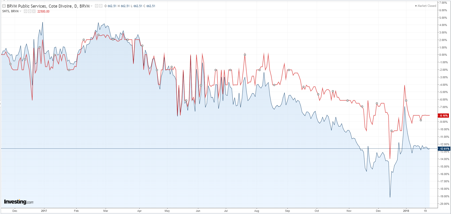

BRVM PUBLIC SERVICE: 10.86% decrease in 2017

The public service sector was severely impacted by the publication of the half-yearly results of the CIE-SODECI binomial. A decrease of 83% of the net profit of the CIE in the first half and a fall of 3% for the SODECI.

These two companies have pulled the whole sector down. Fortunately, SONATEL, which continues to be the safe haven of the market, has cushioned the downturn in this sector.

BRVM FINANCE: 10.46% decrease in 2017

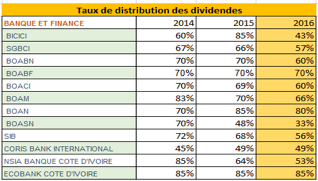

The finance sector was the most dynamic sector in 2017, thanks to two OPVs. Those of NSIA BANK and ECOBANK CI. Although it has outperformed the main index, the finance sector still fell by almost 10%. It should be noted that the 2 BALE 3 AND 2018 regulations coming into force in XNUMX will force banks to put more of their own funds in reserve. This regulation pushes them to prepare.

This has had an impact on the distribution of their dividends (see historic comparative table). Such a decision, of course, does not please investors).

BRVM FINANCE: 10.46% decrease in 2017

The finance sector was the most dynamic sector in 2017, thanks to two OPVs. Those of NSIA BANK and ECOBANK CI. Although it has outperformed the main index, the finance sector still fell by almost 10%. It should be noted that the 2 BALE 3 AND 2018 regulations coming into force, will force banks to put more of their own funds in reserve. This regulation pushes them to prepare.

This has had an impact on the distribution of their dividends (see historic comparative table). Such a decision, of course, does not please investors.

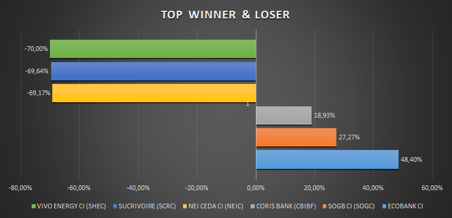

The performance of the main companies during the year

- the calculation was done after readjustment of splits and capital increases

- ECOBANK CI

The ECOBANK OPV was a real success. Indeed, introduced 20 000 FCFA, after 9 trading days the title recorded an increase of 59.48% to reach 31 895 FCFA. The second bank of Côte d’Ivoire has held the entire market in suspense. It also helped to reverse the downward trend in the market, pulling the financial sector higher.

- SOGB

In recent years, SOGB has been a safe haven for investors, and this year has not been an exception. With an average rise in the price of rubber and oil palm on the international market (SICOM 20 and Rotterdam), the title has been propelled as the most profitable value of the market this year (apart from the OPV) with a growth of + 27.27%.

After reaching a growth of more than 50% in the month of April 2017. SOGB has offered at least 8% return to its 2017 investors.

- CORIS BANK

With 29.31’s + 2017% net profit growth and strong prospects in sight, CORIS BANK has been one of the most popular banks for investors. The main bank in Burkina Faso has managed to maintain its growth, despite the collapse of the market this year.

On the other side of the ranking are the main declines of the year.

- VIVO ENERGY CI

Engulfed in a downward spiral caused by an overvaluation of the share price and a turbulent security situation in Côte d’Ivoire, the stock had a disastrous start to the year. Indeed, 2016 end the PER of VIVO ENERGY was the highest of the BRVM to 57.88, then the stock has recorded a sharp decline both (2) first months of the year at – 30.83%.

Despite a net result of 1er 2017 semester slightly up + 3%, the market dictated its law to VIVO ENERGY. The title ends the year with a record loss of 70%. He really lost investor confidence during the 2017 year.

- SUCRIVOIRE

SUCRIVOIRE has been the biggest disappointment of the OPV in recent years. Thus, after one (2) trading month, the stock recorded a loss of 15.38% and gradually lost investor confidence. The publication of 27.24’s annual results (net income down by 157%) and the Company’s third quarter (net profit down XNUMX%) triggered this downward spiral.

The stock thus recorded the second largest decline in the BRVM and seems to have lost the trust of investors. This, despite 549’s excellent dividend distribution FCFA (ie 12.48% dividend yield at 29 September 2017[1]).

Adopted strategy and perspectives 2018

To better understand the decline in the market, a survey was conducted among fund managers in the UEMOA sub-region. The stated goal: to know the time of the year when fund managers felt the market downturn, the strategies adopted and the outlook for the 2018 year.

The information used by the fund managers for the most part, the decline in the market at the end of 1er quarter 2017 (April). And others early in the second quarter.

Strategy adopted

To understand the strategies put in place as a result of the market downturn. They were asked to describe the composition of the portfolio at the beginning of the year and at the end of the year.

The review of the results shows that the share of equities in the portfolio of fund managers has fallen sharply between the two periods. Beginning 2017, shares vary between 35% and 81% of respondents. While year-end 2017, the shares of the shares in the portfolio fall respectively between 20% and 66%.

After seeing the market decline, managers began to reduce their position in equities. The results obtained show that in the second quarter of 2017 some reduced by 10% or more in the second quarter. They then sharply divested into equities to inject their resources into the bond market. Others preferred to keep cash.

These decisions are the result, among other things, of the pressure undergone. At this level, it is important to note that the funds whose clients consist of companies and individuals have been under pressure from them. In addition, the preparation of the announced IPOs and the fall in market share prices have accentuated the divestment.

The divested resources were used to purchase bonds, to reinforce stocks that performed well. Or even investments outside the BRVM market.

However, the fund managers refute the idea that there was a stock market crash in 2017.

Indeed, they almost all supported that the market has just experienced a drop due to external events (see the article on Krach Stock Exchange or simple correction of the BRVM in 2017 for more items).

The survey also looked at investor expectations for the 2018 year. It emerged that investors are optimistic. Indeed, they expect a recovery of the market and rely on an improvement of the indices of the BRVM between 0-5% during the 2018 year.

In addition, they plan to better position themselves on the equity market by counting on the growth of the 10% portfolios during the year.

Read tomorrow, Friday 2 February, “the 2018 perspectives” according to SIKA ADVISORY

[1] TOTAL SN has not been included in the calculation for a better comparison of dividends distributed over the year 2015 and 2016

[2] The 29 September 2017 corresponds to the date of payment of the dividends of SUCRIVOIRE.

Daniel Aggre, Managing Director and Founder of Sikadvisory

Ahmed Diallo (Financial Analyst)

Daniel K. AGGRE (photo) is a financial trainee, holds a Master’s degree in Pure Economics, obtained at the University of Cocody (Ivory Coast) and a Master in Banking and Finance at London Metropolitan University in Great Britain . He has held 10 years as a financial analyst specialty stock market and commercial financial products in the Financial Information Company, Bloomberg.

Daniel AGGRE has a very good knowledge of the African financial markets. As sub-saharan manager ex south africa, he developed financial products for this region. Daniel has worked in the city of London, Geneva and the financial center of Dubai.

He regularly organizes training sessions on stock market techniques in Abidjan. Mr. AGGRE is the Managing Director and founder of SIKAdvisory