Less than two weeks after the arrival of the fund Mediterrania Capital in the round and after a solid rating signed by the agency Wara, Cofina makes its first release on the bond market through the securitization fund FCTC Cofina.

Arranged by Africa Link Capital, the operation launched from 11 April to 11 May 2016 on the financial market of the West African Economic and Monetary Union (UEMOA) consists of the issuance of one million bonds and aims to mobilize 10 billion FCFA. The bond is denominated at a unit price of 10,000 FCFA with a coupon of 7.5% and a maturity of 16 months.

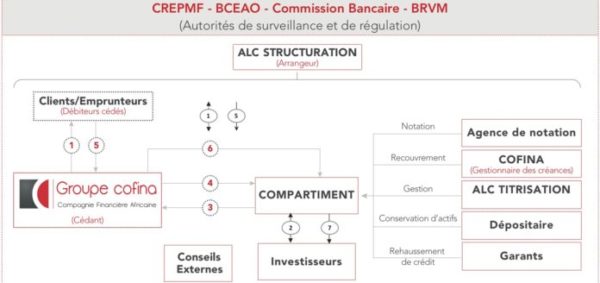

The FCTC COFINA is a Common Fund for the Securitization of Receivables created at the joint initiative of the management company ALC Titrisation, and the custodian UBA Côte d’Ivoire and approved under the number FCTC / 2018-02 by the Regional Council of the Public Savings and Financial Markets. The first sub-fund of the fund (FCTC COFINA 7.5% 2018-2019) consists of commercial loans sold by the Ivorian subsidiaries of the COFINA Group, namely, Compagnie Africaine de Crédit (CAC) and COFINA Senegal.