Integr-All’s research and development team, an actuarial firm based in Douala and led by Eric MANIABLE, provides insurance and social security companies with the best of global innovation, adapted to the context particular of African economies. The anti-fraud tool is the latest innovation developed and tested on a health portfolio of more than 400,000 care records.

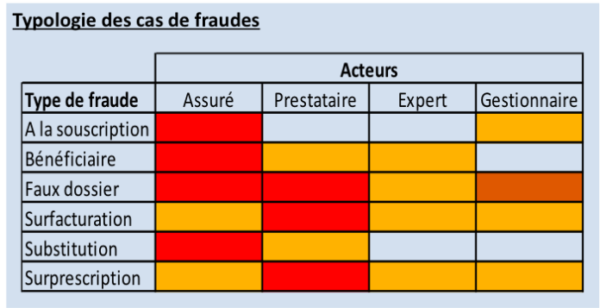

Insurance companies face the challenges of fraud that has many causes and many actors: underwriting fraud, beneficiary fraud, false medical records, overbilling, substitution, overprescription. It is essential for these companies to carry out numerous checks on each claim.

In practice, the insurer has set up a human verification mechanism: control by the manager, identification of suspicious files (which depends on the manager’s experience, his attention, …) or systematic verification rules by a medical consultant , respect of signature powers, segregation of duties, security of access, justification principle, implementation of alerts and processing procedures, etc. Then, it may involve the computer tool to retrospectively search for situations which “outperform” the averages statistically:

- 10 families who received the largest refunds,

- 10 medical providers who received the largest reimbursements,

New techniques or technologies can detect these frauds with lower error rates compared to those of experts: Artificial Intelligence, Machine Learning, …

Machine Learning’s technology allows you to act on large volumes of disaster files, by detecting suspicious and non-suspicious claims in real time. This technology makes it possible to optimize the verification time of different files, reduce management costs, while keeping a very high level of detection. In addition, the tool is designed in such a way that, as the input data is provided, it continues to learn. The performance of the model is improved by the increase in data provided to it.

Enforcement

On a portfolio of more than 400,000 health insurance files of a local company, it was built a tree of decision, obtained from Machine Learning.

The tool has been tested for 3 months, and the results show a model performance of around 92%. That is to say, in 92% of cases, it identifies the same suspicious or non-suspicious files as managers and medical advisers.

In addition, the model proposed to appraise 7% of additional files, whose characteristics are close to the actual fraudulent files. That is to say that the model improves the detection made by collaborators, sometimes tired, less vigilant, …

The real “error” made by the model represents 0.9% of the files, which were fraudulent but that he did not know how to suspect.

The quality of the tool will depend on the care that the insurer has taken in the capture of various information. The most important work is the modeling of the tool from the data of each company: choice of variables, reprocessing of information, choice of the optimal level of the model, …

The gain in automated detection of suspicious records is assessed in four key areas:

- Performing real-time detection, it saves the work of managers who can better focus on supervision, customer relationship, …

- Can also be used for quotes, it avoids issuing some good care that could be suspicious, and therefore work well upstream

- The detection of suspicious files (not seen by the human eye) far superior to the files not suspected, and thus a better responsiveness

- Constant learning, the model using the results of expertise to improve the criteria and detection accuracy

This type of tool also makes it possible, with almost no cost, to re-examine the claims already settled, and to detect ex post facto suspicious files, within the framework of article 28 of the CIMA code.