The public offering (OPV) of approximately 13 million Oragroup shares will start on 29 October at the Abidjan Securities Exchange (BRVM) and is expected to continue until 16 November.

As we announced, the transaction involves 57 billion CFA francs (86 million euros, a record at the BRVM), divided between a capital increase of 25 billion CFA francs and a sale of 31 billion Francs. CFA. At the end of the operation, ECP will remain the reference shareholder with 50%. The float will be 20%, which is the floor at the BRVM.

Many market analysts, who have followed end-to-end the latest introductions of bank stocks to the BRVM (SIB, NSIA Bank, Coris Bank International, Ecobank CI) believe that early closure remains highly probable. This is certainly due to the thirst of the market, weaned fresh paper for a year. But, basically, it is especially the quality of Orabank paper that will make the difference.

The consistent business plan combined with institutionalized governance and an average increase of 35% in performance indicators between 2014 and 2017 are factors in assessing the strength of this bank which, as recalled by its CEO Binta Ndoye Touré , is present in 12 countries and four currency areas. “Our returns are balanced thanks to our geographical diversification,” says Ndoye Toure who was speaking on the sidelines of a press conference held Wednesday (October 24th) in Dakar.

In 2017, the bank posted a net profit of 21.97 billion CFA francs ($ 40.1 million), up 45%.

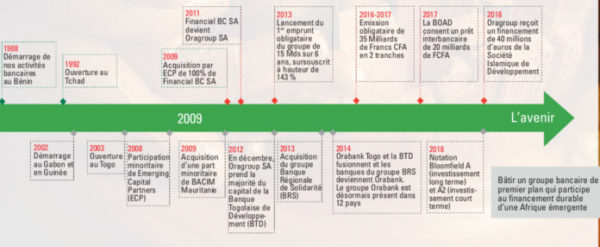

Since the emergence of Emerging Capital Partners (ECP) in the capital of Orabank ten years ago, the bank has seen its valuation multiplied by four. “The share has gone from a face value of 10,000 FCA at the time of the entry of the US fund to more than 40,000 CFA francs,” says Amadou Ly, Executive Director.

The synthesis of different valuation methods combining the consolidated business plan of the group, the addition of subsidiary business plans by subsidiary and the stock market comparables resulted in this level of valuation considered attractive given the medium-term projections.

Clearly, the valuation was correct, says Cyrille Yode, Head Of Investment Banking Hudson & Co., leader of the syndicate, which insists on the multiple king of the scholars, namely the price to book, relationship between valuation and own funds. This is 1.89x in the Oragroup case, well below the ratios applied during the last IPOs on the banking sector.

The result of the OPV should allow to “consolidate the leadership” of the Bank in some countries, continue capturing market share and support the digital transformation. On the other hand, it is envisaged in the medium term to open subsidiaries in Cameroon (tracking and contacts in progress) and Congo Brazzaville.

With 149 branches and a portfolio of 43,000 fast-growing clients, Oragroup views the IPO as a structural operation where operational performance outweighs the return on the security. At the market to give his opinion.