By Daniel Aggre, Sika Advisory.

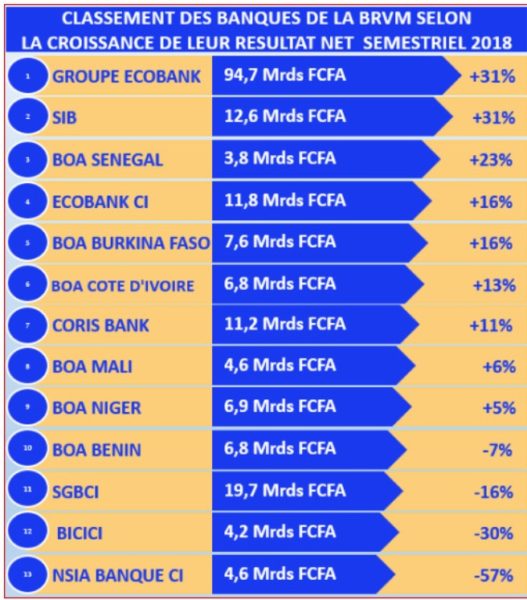

In a context of difficult exploitation with the entry into force of the Baloise provisions and the liquidation of the SAFCACAO Group, banks listed on the BRVM have been tested, but they still managed to generate a net profit up + 11% at 192.6 billion FCFA at June 30, 2018 against 173.5 billion FCFA a year earlier.

The ECOBANK Group and the SIB are the institutions with the strongest net profit growth. For both institutions, net profit rose by 31%, to 94.7 billion FCFA for the ECOBANK Group and 12.6 billion FCFA for the SIB, despite a provision of 50% of its receivables held in SAF. COCOA.

Despite a contraction in its net banking income of 2%, BOA SENEGAL managed to generate net income up + 23% to 3.8 billion FCFA.

BOA SENEGAL, ECOBANK CI, BOA BURKINA FASO, BOA IVORY COAST and CORIS BANK INTERNATIONAL posted double-digit growth in net income.

The trio (SGBCI, BICICI and NSIA BANQUE C) recorded the largest contractions of their net profit due to significant provisions made as a result of their exposure on the SAFCACAO file.

That of the SGBCI contracted by 16% to 19.7 billion FCFA, while that of the BICICI fell by 30% to 4.2 billion FCFA. At the NSIA BANQUE level, after having made a 50% provision of its exposure on the SAFCACAO file, its net profit fell by 57% to 4.56 billion FCFA.