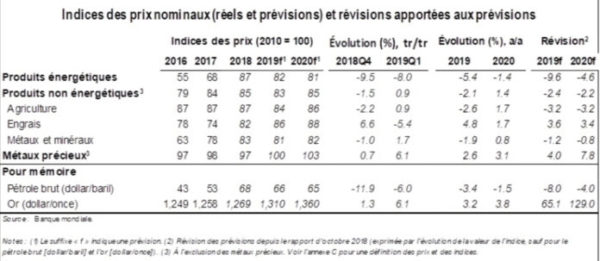

Weaker-than-expected global growth prospects and higher-than-expected oil production in the United States led to a downward revision to the oil price forecast for October 2018, says the World Bank, which is banking on a barrel of oil. averaging $ 66 in 2019 and $ 65 in 2020.

According to forecasts by the World Bank in its April Commodity Markets Outlook delivery, metal prices are expected to continue their recovery in 2019, following the sharp decline recorded in the second half of 2018. This dynamic is due to the stabilization of the market. activity in China after the slight decline observed at the end of last year as well as by supply shortfalls.

“Obviously, the commodity price cycle has ended and if exporting countries suffer from this development, it opens up opportunities for importing countries,” said Ceyla Pazarbasioglu, World Bank Vice President for Fair Growth, finance and institutions. Exporting countries will have to adjust to declining commodity revenues by diversifying their economies, while importing countries will benefit from lower prices to boost their investment. ”

“Obviously, the commodity price cycle has ended and if exporting countries suffer from this development, it opens up opportunities for importing countries,” said Ceyla Pazarbasioglu, World Bank Vice President for Fair Growth, finance and institutions. Exporting countries will have to adjust to declining commodity revenues by diversifying their economies, while importing countries will benefit from lower prices to boost their investment. ”

Prices for agricultural products are expected to fall by 2.6% in 2019 before rebounding in 2020, reflecting lower production and higher energy and fertilizer prices. The escalation of trade tensions is expected to pull prices down, but the stronger than expected rise in energy prices could have a bigger adverse impact than anticipated.

“The prospects for commodities are sensitive to public policy risks, especially when it comes to oil,” says Ayhan Kose, director of the Outlook Study Group. A series of decisions, including from the Organization of the Petroleum Exporting Countries and its partners, on further reductions in production, the degree of compliance with recent sanctions decisions against Iran, and the amendment imminent emissions regulation in shipping could reverse these forecasts.

After a dip in late 2018, oil prices have risen steadily since the beginning of the year, fueled by the production cuts decided by OPEC countries and their partners and a drop in volumes produced in Venezuela and Brazil. Iran. After the excellent performance of 2018, oil shale production in the United States is expected to remain robust. Overall, energy prices, including natural gas and coal, are expected to fall by an average of 7.9% in 2019.

In a special report on public interventions to mitigate the impact of food price fluctuations, the report shows that measures taken in concert by several countries may have the opposite effect of amplifying variations, to the detriment of the most vulnerable populations.