The Stock Exchange of Casablanca has evolved, throughout the session of 12 November 2 029, following a bearish trend to close, in fine, negative zone, reports Crédit du Maroc in its daily note.

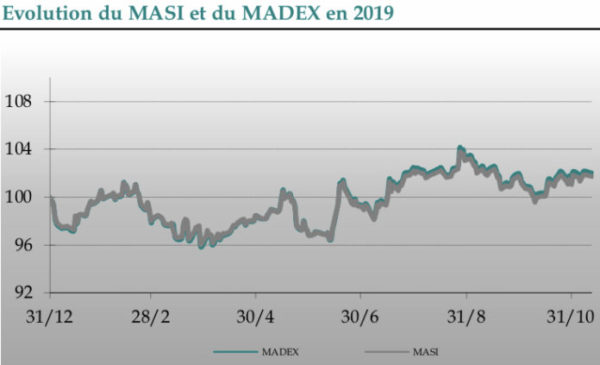

To this end, the market positions the annual evolution of its flagship index just below the + 1.75% threshold, in which case the MASI deteriorates by 0.14% while the MADEX loses 0.17%. . At this level, the YTD variations displayed by the two main indexes of the rating are reduced to + 1.74% and + 2.01%, respectively; In stride, the overall market capitalization totals nearly 596.24 billion MAD down MAD 1.08 billion compared to the previous session, a decrease of 0.18%; In terms of the biggest fluctuations in the session, we note the good behavior of the SONASID trio (+ 7.46%), CREDIT MOROCCO (+ 5.91%) and EQDOM (+ 5.88%). Inversely, the values: INVOLYS (-2.79%), SNEP (-3.23%) and AGMA (-5.59%) are at the bottom of the pack, fully drained in the central market, market transactions generated an overall volume of 30.86 MMAD, a decrease of 72.7% compared to last Friday. In this sense, ATTIJARIWAFA BANK alone gained more than 46% of trading by posting a negative performance of -0.48%, while EQDOM, BMCI, and BCP securities jointly concentrated 37 , 64% of transactions ending the day with contrasting variations including a + 5.88% gain for the finance company as well as losses for the banks of -1.69% and -1.19%, respectively.

Source: Morocco Credit