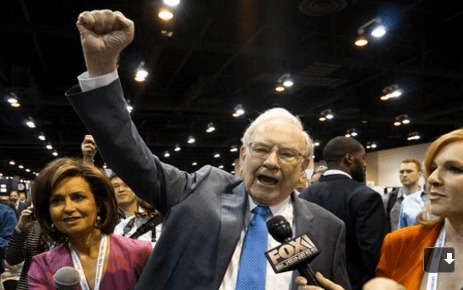

At the Berkshire Hathaway fund’s general meeting held on Saturday, May 1, attention was no more focused on the first quarter results of this famous structure, marked by a profit of 11.7 billion dollars albeit with performance. less than those of the S&P 500, that its founder, appeared in videoconference with his collaborators. At 90, Warren Buffet remains the most popular investor in the stock market thanks to his wise advice.

For this vintage, his word has focused on fashionable instruments. Mute on the Bitcoin on which he was arrested, the oracle of Omaha was harsh on Robinhood, these platforms which transform the Stock Exchange into a casino and particularly talkative on the SPAC, these “empty shells” which make the whole Wall Street run. at the moment. In particular, Buffett believes that these vehicles often have very short time horizons on which they must deploy funds, for example only six months, or return them to investors and thus waive future management fees.

Sitting on $ 145 billion in cash despite a 2020 record $ 24.7 billion own share buyback program, Berkshire Hathaway remains reluctant to trend, postponing publication a clear charter on respect for the environment.

Advice that is worth gold

True to his line of thinking, Buffet reiterates his advice that the average investor is best served by investing in an S&P 500 index fund, not by trying to pick stocks. By way of illustration, he presented the lists of the world’s 20 largest companies by market capitalization in 1989 and 2021. None of the top 20 companies in 1989 is in the top 20 today. In addition, the largest company in the top 20 today, Apple Inc. (AAPL), with a market capitalization of over $ 2 trillion, is more than 20 times more valuable than the largest company of 1989. ” Be on board the ship, ”he advised, however, suggesting that doing“ 30 to 40 transactions per day ”is not a wise way to invest.

New investors are generally attracted to industries. However, more than 2,000 industrial companies have disappeared in the United States alone. In 2009, there were only three American automakers, two of which were bankrupt at the time, says Buffet, who believes that there is a lot more to choosing stocks than the wonderful industry.