Paris is due to host an international conference on new development financing on May 17 and 18. This meeting is part of the measures already put in place in recent months by the G20 to enable African economies to face the consequences of Covid 19.

If the alarmist forecasts related to this pandemic have not been proven from a strict health point of view, the economic effects are, on the other hand, already being felt. While observing a cycle of positive growth for more than twenty years, the continent has entered recession according to the International Monetary Fund (IMF). In 2020, it posted negative growth of over 2%.

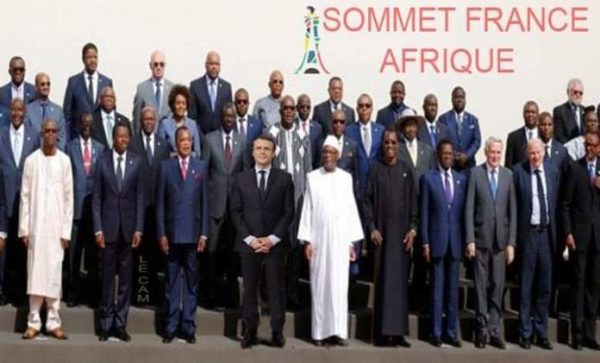

The shock is potentially more violent than in other parts of the world, Africa not being equipped to face this context. The twenty heads of state and heads of international financial organizations expected in the French capital will work on the best means of supporting the recovery with targeted initiatives. “There is a great risk of performance divergence or even a gap with the rest of the world if African economies are not supported,” said Alain Leroy, special envoy of the Presidency of the French Republic for the Africa-Covid19 initiative, during a press briefing on May 12 on this event.

The first initiative will focus on financing needs. In Africa, these amount to several hundreds of billions of dollars, far from the tens of billions of dollars already granted in urgent aid by the IMF or the African Development Bank (AfDB). The idea is to increase the volume of Special Drawing Rights (SDRs) issued by the Bretton Woods institutions that could benefit the African continent. While the IMF must approve, next June, the issue of 650 billion SDR as part of the global recovery, only 34 billion are reserved for it corresponding to its quota in the fund, including $ 24 billion for Sub-Saharan States.

While industrialized economies must capture 400 billion of these SDRs, Emmanuel Macron believes that developed economies can temporarily do without such massive aid. With his counterparts, the French president is pushing for a relocation of this envelope.

Other discussions will focus on debt relief following the decision taken by the G20 last November to restructure that of several African countries. This framework has been adopted by the twenty-two member countries of the Paris Club as well as five other countries: India, China, Saudi Arabia, Turkey and South Africa. Seventy-three countries in the world are eligible for restructuring, 38 of which are located south of the Sahara. After adopting a moratorium on debt service until June 2021 in April 2020, the G20 agreed to examine requests for rescheduling or even cancellation of debts on a case-by-case basis. The other initiative concerns the perception of African risk. The conference participants must find an agreement in order to increase reforms on the business environment, but also to try to influence the rating methods of international agencies, which contribute to the negative perception of African markets.