By *Ndongo Samba Sylla and *Peter Doyle

The International Monetary Fund (IMF) recently launched its World Economic Outlook (WEO) in Washington with great fanfare. Owing to this institution’s major influence over the formulation of public policy in most countries worldwide, it is important to exercise vigilance regarding the quality of its analysis.

For, as we all know, the lives of billions of people are affected by the IMF programs and the policy conditionalities and prescriptions attached to them. IMF analytical errors can therefore have devastating consequences.

In Senegal, the IMF is back in the spotlight thanks to current debates on the country’s public finances. A new program is currently being negotiated with the Senegalese authorities.

In this short piece, we would like to draw attention to gross errors in the IMF’s projections for Senegal, notably those relating to inflation.

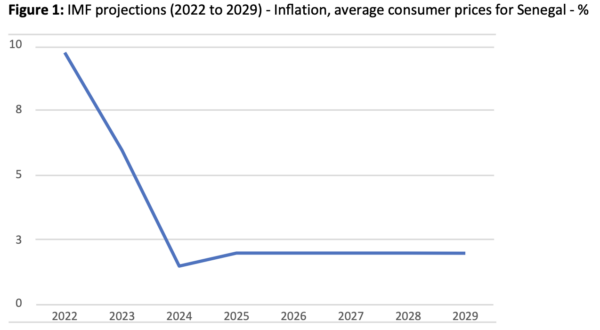

As can be seen from the WEO database, the IMF projects an average inflation rate of around 2 % each year between 2025 and 2029. These estimates are broadly in line with the April 2024 vintage of the WEO (See Figure 1), though they may be optimistic for the 2024-2026 period, given the expected reduction in energy subsidies. So far, so good.

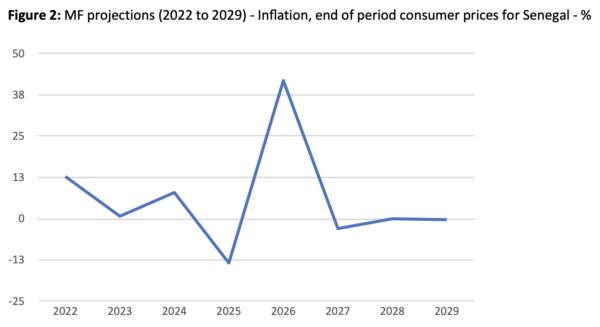

However, the latest IMF projections for end-of-period inflation are simply not possible. The October 2024 WEO projects end-of period (or 12-month consumer price inflation) of -13.4 % in 2025 and 41.9 % in 2026 (See Figure 2).

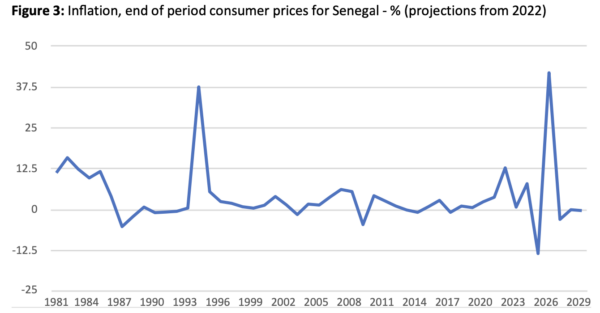

There is simply no logical or factual basis for such projections. They even contradict the IMF’s own projections for average annual inflation for the years 2025 and 2026. The only time the end-of-period inflation reached more than 20 % was in 1994, the year when the CFA franc was devalued by 50 % vis-a-vis the French Franc. End-of-period inflation stood at 37.5 % in that extraordinary year (See Figure 3). And even then, the prior end-of period inflation rate, for 1993, was certainly not a negative number above 10 percent.

Such blatant errors on the part of the IMF for Senegal, in its most recent and high profile analysis, are a matter of major concern if, as is often the case, they are the tip of the iceberg in terms of errors elsewhere in the IMF projections in which those numbers are embedded.

In that case, there is evident risk of inappropriate conditionality being forced on Senegal.

And this is no theoretical risk. Errors in conditionality consequent on numerical miscalculations by the IMF have been seen recently elsewhere in IMF programs in Africa, including in the latest IMF program review for Kenya. There, not only are the IMF end-of period inflation projections for 2024 also simply not possible, but in addition, their projections for public debt fail to reconcile the fiscal flows (borrowing) with the fiscal stocks (debt) data.

It is essential, as a matter of respect for sovereign nations if nothing else, that the IMF ensures that its projections meet the highest professional standards. In the case of those for inflation in Senegal, right now, this requirement is simply—and obviously—not being met.

*Ndongo Samba Sylla,

Senegalese Economist at the International Development Economics Associates (IDEAs)

*Peter Doyle,

American Economist, former IMF and Bank of England.

![[Tribune] The IMF’s impossible projections for inflation in Senegal](https://www.kapitalafrik.com/wp-content/uploads/2024/11/Ndongo-600x413.jpg)