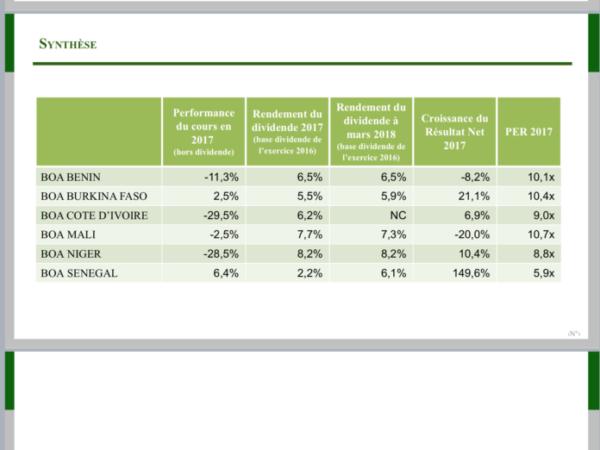

The 6 Bank Of Africa subsidiaries in the UEMOA Zone posted rather mixed results in 2017. This emerges from the brief presentations of the activity presented to the press on 20 April.

BOA Benin accuses foreign exchange losses

BOA Benin is getting closer to a total balance sheet of 1,000 billion FCFA. At December 31, 2018, BOA’s largest subsidiary by size had assets of 974.5 billion, up 7%. The bank’s net banking income rose 0.7% to 39.6 billion FCFA. As for the net result, it shows a decline of 8.2% to 14.8 billion FCFA.

The decrease in net income is due to an exceptional foreign exchange loss in 2017 and an exceptional recovery in 2016.

BOA Benin remains the leading bank in terms of credit market share with 24.7% market share. It is also the largest bank in Benin in terms of market share deposits with 25.4% of PDM.

The negative evolution of the net result in 2017 is due to exceptional write-backs of provisions for risk on a case in 2016 and the exceptional foreign exchange loss in 2017 on a participation. These non-recurring events restated, the net result would have increased by 17.6% in 2016, and by 18.0% in 2017.

BOA Burkina Faso solid on its fundamentals

The total balance sheet of the bank rose by 7.4% to 757.1 billion FCFA. GNP gains 10% to 37 billion FCFA. As for the net result, it realizes a jump of 21% to 15 billion FCFA.

2nd bank in terms of credit market shares with 16.5% and 3rd bank in terms of market share deposits with 16.2%, BOA Burkina Faso appears solid on its fundamentals.

BOA Ivory Coast impacted by investments

BOA Ivory Coast saw its total balance sheet increase of 2.9% to 642.5 billion FCFA, impacted by the decline in investment income. Net banking income improved by 4.9% to 30.4 billion FCFA. Net profit rose 6.9% to 10.9 billion FCFA. The bank has a mixed evolution at the BRVM. The stock, which had risen by 35% in 2016, lost 29% in 2017.

BOA Mali falls back on an exceptional recovery

Bank Of Africa Mali saw its total balance sheet decline by 7.6% to 457.4 billion FCFA. Net profit fell by 20% to 7.5 billion FCFA due to an exceptional provision reversal in 2016. On the stock market, the BOA Mali share is down 2.5% in 2017 following a rise in 65% in 2016.

BOA Niger on a regular curve

The total balance sheet of BOA Niger rose by 5.8% to 294.5 billion FCFA. Net banking income and net income rose by 2.8% and 10.4% respectively to 19.6 billion CFA francs and 7.2 billion CFA francs.

BOA Senegal, champion of growth

BOA Senegal realizes a net profit of 10 billion FCFA in growth of 149,7%. The total balance sheet progressed by 13% to 463 billion FCFA and the GNP to 15% to 25.3 billion FCFA. Note a contraction of 14% of deposits. At the BRVM, the price, which fell from 40.5% in 2016, ended 2017 up 6.4%. Taking into account the exceptionally low PER of the stock, it is certainly worth accumulating in its portfolio.