Ghana is expected to count from May 10 launch the interoperability, highly anticipated, mobile money systems. The operation will be conducted under the supervision of the Bank of Ghana and its subsidiary dedicated to the facilitation of electronic money, Ghana Interbank Payments and Settlements Systems.

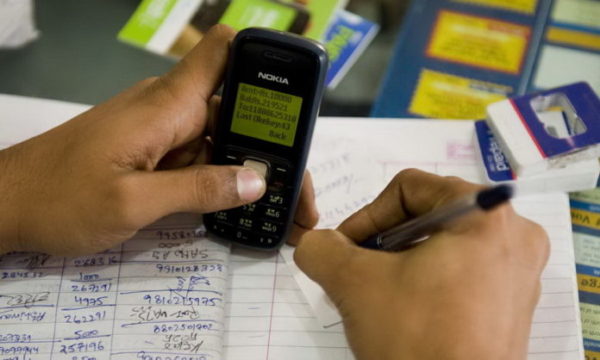

The system will allow Ghanaians to send funds from one mobile money operator network to another in a transparent manner. And in the macro framework, the operation will allow a smooth transfer of funds from bank accounts to the mobile money wallet and e-zwich cards (brand name of the national payment system Switch and Smart Card of Ghana) .

According to Archie Hesse, CEO of Ghana’s Interbank Payment and Settlement Systems (GhIPSS), the first phase of the system this week, while two more phases will follow.

The interoperability of mobile money represents the latest attempt to modernize Ghana’s financial sector, which already has several operational electronic payment channels and an automated clearing house that provides direct credit and direct debit services.

In February 2018, the central bank of Ghana revealed that the value of deposits and withdrawals by Ghanaians using mobile phones for banking services almost doubled in 2017. The report added that the value of mobile transactions is last year ceded 155.8 billion cedis ($ 34.6 billion) from c78.5 billion in 2016.

According to a 2017 report by GSMA Intelligence, over 40% of the adult population in Ghana regularly uses mobile money.