The decentralized financial platform, Humaniq, has just announced the extension of its wallet and courier application for the unbanked populations of Kenya, Côte d’Ivoire, Botswana and Ghana.

The application currently has more than 180,000 downloads on Google Play and provides equitable access to financial services, cash transfers, and social programs to ten African countries in total. Building on a successful ICO that raised more than $ 5.1 million, Humaniq is also entering markets such as South Africa to develop a competitive mobile ecosystem. The application also allows its users to make small transactions with transaction fees close to zero.

In Africa the platform is already present in Uganda, Senegal, Zimbabwe, Tanzania and Rwanda. The expansion comes as sub-Saharan Africa faces significant financial challenges: the lack of infrastructure has served to curb the economic situation of these countries.

“The first months of the application show that Africa is becoming a leader in the adoption of the transactional mobile payment model. Our development team is pleased to provide financial inclusion solutions for the 2.5 billion unbanked people and we hope to inspire new users and gain their confidence as we introduce them to a new world safely from the free services of financial burden, “said Anton Mozgovoy, Executive Director of Technology (CTO) Humaniq.

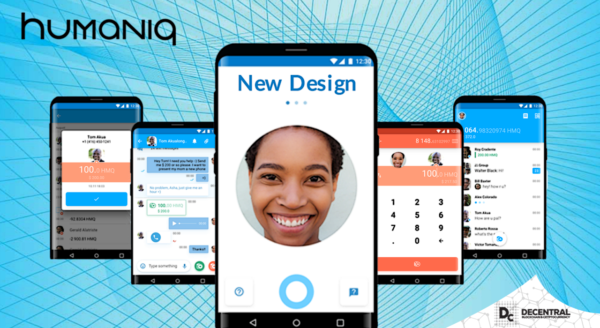

Humaniq is a London-based company that provides next-generation financial services using its Blockchain mobile application for the unbanked and disadvantaged in emerging economies around the world.