Published by the Standard Investment Bank, the latest semiannual study on the Nairobi Stock Exchange confirms that many operators in the Kenyan financial market have seen for some time: volumes are back.

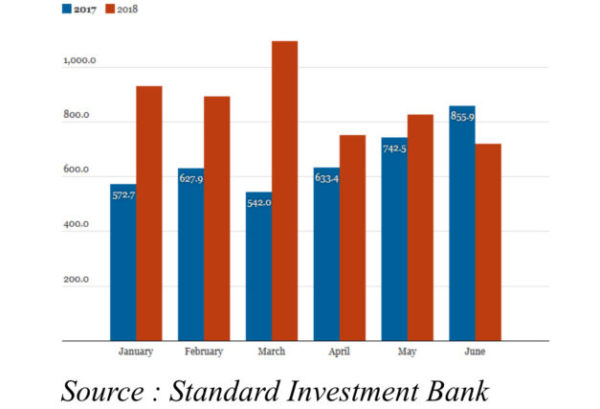

According to data provided by the SIB, the average daily turnover traded on the Nairobi Stock Exchange was 868 million shillings ($ 8.65 million) in the first six months of the year, an increase of 31% compared to the same period last year.

The daily peaks were realized in March, with an average daily volume of 1.1 billion shillings ($ 11 million), and coincided with the highest stock market reached by the NSE 20 equity index, which approached 3,900 points on March 21st (against 3314 points at the close on July 20th).

Only downside, much of this expanded activity then resulted in a sharp decline in equity indices during the second quarter (April 1 to June 30), “foreign institutional investors” disengaged “from the market after the end of the dividend season and [selling] more than 4 billion shillings ($ 40 million) net of securities in the month of May alone, “noted Standard Investment Bank in its previous market note.

This mass of securities entering the market for sale should, however, benefit brokers, the latter being paid transaction volumes (up to 2.1% commission per order executed in Nairobi).

In any case, the final effect of this increase in activity will be seen when the brokerage firms publish their half-year results in the coming weeks.

Average daily volume on the Nairobi Stock Exchange (in million shillings)