Banks operating in Cameroon had a turnover of 5,308 billion CFA francs in 2017 representing 26.8% of Gross Domestic Product (GDP), against 23.1% in 2010, according to a report by the International Monetary Fund ( IMF) published this month of October.

The document mentions that “of the 14 banks operating in 2017, the assets of the nine foreign banks are estimated at 3,422 billion CFA francs, three private local banks represent 1,376 billion CFA francs while two state-owned domestic banks have 271 billion CFA francs. CFA in terms of assets “.

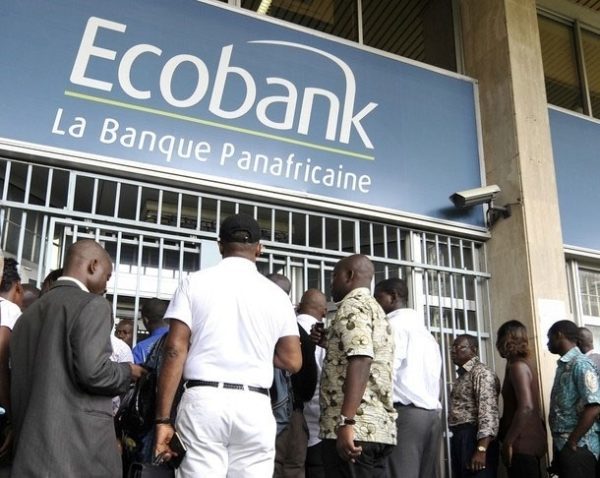

It is also noted that at the end of the year, the 4 largest banks in the country (Afriland First Bank, Société Générale, Bicec and Ecobank) alone accounted for 59.2% of total assets.

In its report, the IMF also emphasizes that “banks remain profitable especially as liquidity conditions have improved thanks to the loosening of the government’s liquidity constraint after disbursements of budget support”. As a result, the refinancing of the Bank of Central African States (BEAC) amounts to 72 billion CFA francs at the end of 2017, compared with 200 billion CFA francs in the first half of 2017.