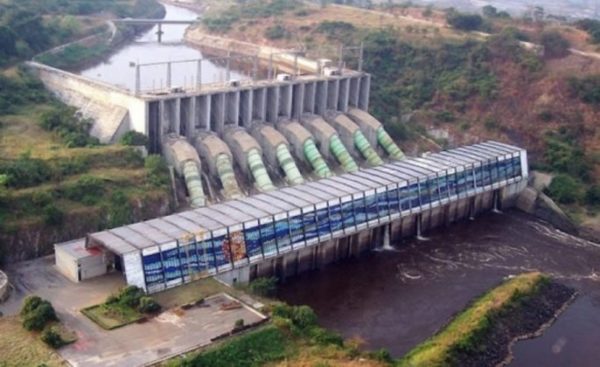

The World Bank has opened a line of credit in the form of a guarantee for project developers including Electricité de France for the construction of this hydroelectric dam which will bring a substantial energy supply for the country.

By Achille Mbog Pibasso, Douala

Cameroon, which aspires to become an emerging economy, must improve the energy supply, which currently covers only 62% of the country’s total population. With a view to improving electricity production, the World Bank, through the Multilateral Investment Guarantee Agency (MIGA), has granted a loan of FCFA 108 billion to Cameroon for the construction of the Nachtigal dam. This financing represents the guarantee of the investments of Electricité de France (EDF) and Stoa Infra & Energy for this dam with a capacity of 420 Megawatts (MW). The financing agreement for the construction of this new dam was signed in November 2018 between the Cameroonian government and some 20 partners, including the International Finance Corporation, a subsidiary of the World Bank Group, which is its head. EDF and Stoa Infra & Energy hold respectively 40% and 10% of the assets of Nachtigal Hydro Power Company (NHPC), the company responsible for the development and operation of this hydropower project. In the long term, the Nachtigal dam on the Sanaga River, along with the Edéa and Songloulou hydroelectric dams, will provide an additional supply of 30% of the country’s electricity generation capacity.

With a cost of 656 billion FCFA, this hydroelectric infrastructure could be commissioned in 2021. According to NHPC officials, the project to build the Nachtigal Amont hydroelectric plant is “a priority for the State of Cameroon in to the extent that it will enable it to have a significant additional source of stable electricity production by 2020. It is part of a vast program to promote the hydroelectric potential of the Sanaga Basin “. EDF will be responsible for designing the plans for the future infrastructures, constructing them and then operating the hydroelectric power station for 35 years, while the Agency has provided a guarantee of breach of contract for up to 15 years. The other investors in this project are the International Finance Corporation (IFC), which controls 20% of NHPC’s assets, the State of Cameroon 15% and the Africa 50 fund 15%.