Sovereign debt defaults hit a record 7 in 2020, with the COVID-19 pandemic and falling oil prices affecting credit quality globally. By the end of 2020, the number of sovereigns rated at the lowest rating levels, ‘CCC +’ and below, had risen to seven, suggesting defaults may remain high for years to come, ”Nick said. Kraemer, Head of S&P Global Ratings Performance Analytics. Sovereign ratings could continue to come under pressure amid the expected massive fiscal and monetary stimulus that will leave substantial debt overhang for several years to come.

Suriname was the sovereign with the best profile with a long-term “B” rating in foreign currency. Two of the defaulters, (Ecuador and Belize), were rated “B-” at the start of 2020, and three (Zambia, Lebanon and Argentina) obtained the lowest category rating, “CCC” / “CC”. Latin America recorded the most defaults, with five defaults, from Argentina to Belize, Ecuador to Suriname (which recorded two defaults). The other two defaults, Lebanon and Zambia, are from the Middle East and Africa.

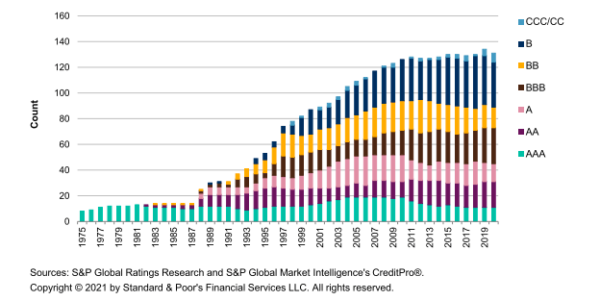

All affected states were rated “B” or lower early last year, reports Standard and Poor’s. Most of the 26 sovereign rating downgrades involved issuers rated speculative in emerging and frontier markets. Despite unprecedented economic, social and financial market shocks, sovereign ratings posted strong performance in 2020.