It’s been eight now years that Financial Afrik, parent group of Capital Afrik, presents each year its ranking of those who are transforming Africa. Until 2017, this list was compiled by the editorial staff of Financial Afrik and its columnists external. On December 11, 2018, we designate for the first times the “Minister of the Economy and Finance of the Year» and “Financier of the Year” at end of a ceremony and a conference debate devoted to financial communication. Since then, the exercise has expanded from year to year and from country to country country with a first work of cooptation carried out by the committee of selection on the basis, not of turnover or wealth, not from the academic background or diplomas, but achievements over the last 12 months, the social and environmental impact and, for many self-made men, who sign the awakening of the continent, risk taking in Africa.

Like any choice relating to profiles belonging to different sectors, to businessmen of different sizes, this ranking certainly includes a part of subjectivity but perfectly assumed by the technicality of the selection and attenuated by the independence of the jury. This year’s theme, “Africa in green finance”, the central subject of the Lomé conference, echoes, a few weeks after the closing of COP 27, the great shift in the world economy. Until then based on fossil energy, the economy is seeking the best possible paths for a transition that will allow it to keep the rise in temperature below 2 degrees in 2100. In this perspective, there are fights in principle and strategic battles to win. It is a question of institutionalizing at the international level the loss-damage mechanism allowing rich countries to transfer a financial contribution necessary for the energy transition in the countries of the South. Africa, which accounts for only 3% of pollution in the world, must do everything to develop its solar, wind and water potential while ensuring that its gas reserves serve the common good of humanity. The 100 personalities presented here contribute to it, directly and indirectly.

List of trophies

• Special Lifetime Achievement Award,

• Minister of Finance of the Year

• Development Banker of the Year

• Special Prize for Female Leadership

• CEO of the Year

• Financier of the Year

• Asset Manager of the Year

• The green deal of the year

• The deal of the year

• The Economist of the year

• The Fintech of the year

• Electronic banking integrator of the year

• Prize for the best SME

FINANCE MINISTERS OF THE YEAR

| Country | Growth | Debt/GDP | Inflation | Total |

| DRC | 6,1% | 16,49% | 11,7% | 47,91 |

| Nigeria | 3,5% | 23% | 20,8% | 29,7 |

| Benin | 6,3% | 49% | -1,3% | 28,6 |

| Togo | 5,9% | 60,28% | 6,9% | 8,72 |

| Seychelles | 10,6% | 72,85% | 4,78% | 2,97 |

| Maroc | 1,1% | 68,94% | 6,2% | -4,04 |

Methdolohy

The calculation of points is based on the difference between the debt of the country in question and the debt ceiling allowed (70%). This difference is positive for countries with a debt below 70% and negative for those below. The score thus obtained is added to the GDP growth rate less inflation. Source: World Bank, IMF, Fitch.

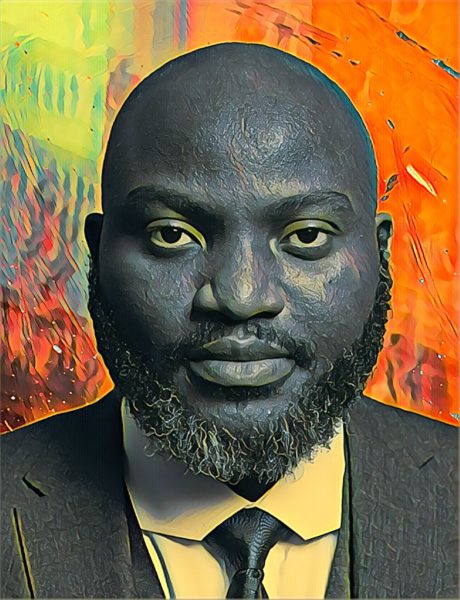

Nicolas Kazadi, DRC

Nicolas Kazadi, 56, Minister of Finance of the Democratic Republic of Congo since 2021, has successfully initiated a series of major reforms and, with the Central Bank of Congo, to remove his country from the gray list of finance international. Since 2021, the DRC has concluded a three-year program with the International Monetary Fund. In early November, Kinshasa saw Moody’s raise its rating from Caa1 to B3, with a stable outlook.Nicolas Kazadi, 56, Minister of Finance of the Democratic Republic of Congo since 2021, successfully initiated a series of major reforms and , with the Central Bank of Congo, to remove his country from the gray list of international finance. Since 2021, the DRC has concluded a three-year program with the International Monetary Fund. In early November, Kinshasa saw Moody’s raise its rating from Caa1 to B3, with a stable outlook.

Zainab Ahmed, Nigeria

Zainab Ahmed, 60, Minister of Finance of Nigeria, became known for her initiatives to get the economy of her country out of all oil. According to the National Development Plan 2021-2025, the $100 billion development program will be spent on achieving the Sustainable Development Goals. The country’s challenge is linked to debt control. Nigeria (B stable at Fitch) still needs to borrow $19 billion in 2023.

Romuald Wadagni, Benin

Romuald Wadagni, 46, minister of State in charge of the Economy and Finances du Benin, succeeded in 2021 in the first bond aligned with the sustainable development goals (SDGs) of Africa. In office since 2016, the minister successfully completed a program concrete reforms of the business climate cases which has strengthened the legal certainty of companies. Benin (B+stable outlook at Fitch) is the first African country to align its development program (PND) with the Sustainable Development Goals (SDGs).

Sani Yaya, Togo

Minister of Economy and Finances of Togo since 2016, Sani Yaya, 59, distinguished himself in consolidating the vocation of Togo as as the logistics and financial hub of the sub region. The environment of renovated business explains the attractiveness of the place of Lomé with the investors. Thanks to targeted reforms, the port of Lomé has become the leading port infrastructure in the WAEMU zone. The country’s economy is expected to grow by more than 6% in 2022. One of the major challenges ahead remains the reduction of public debt estimated at 72% of GDP in 2018. In 2019, Togo obtained its first financial rating (B with stable outlook) from Standard & Poor’s. A graduate of the Center for Financial, Economic and Banking Studies (CEFEB) in Paris and holder, among other things, of a DESS in Management from the University of Paris 1 Panthéon-Sorbonne as well as a Master’s in Economics from the University of Lomé, Sani Yaya worked for 6 years at the Central Bank of West African States (BCEAO), at the Banking Commission of the West African Economic and Monetary Union (UEMOA), at Ecobank, at NSIA and at the African Development Bank as a member of the Board of Governors.

Naadir Nigel Hamid Hassan, Seychelles

In office since November 2020, Naadir Nigel Hamid Hassan, 40, was part of the Finance team which initiated discussions to launch the process of Seychelles’ accession to the World Trade Organization (WTO) as well as agreements trade with the European Union. It also initiated the process of significant tariff liberalization. Educated at the University of Manchester (2001-2005) and holder of a bachelor’s degree with honors in international business, finance and economics and a master’s degree in banking and finance at the University of Sitirling, he joined the Ministry of Finance in 2005, in the Department of Policy and Strategy. Subsequently, he joined the Central Bank of Seychelles (CBS) as a Public Debt Officer and was soon transferred to Financial Services Supervision as a Services Analyst. from 2007 to September 2009. He rose through the ranks as Senior Financial Services Analyst, Director and eventually Head of Department. After 14 years at CBS, in July 2020 he joined Cable and Wireless Seychelles as Chief Digital and Risk Officer. Since November 2020, he has overseen major macroeconomic reforms in the Seychelles with a view to diversifying the economy, which is overly dependent on tourism.

Nadia Fettah Alaoui, Maroc

Moroccan Minister of Tourism, Handicrafts, Air Transport and Social Economy from 2019 to 2021 then Minister of Economy and Finance since October 2021, Nadia Fettah Alaoui, 51, is a graduate of the Ecole des Hautes Etudes Commerciales de Paris (HEC). At rank of its priorities, the improvement of tax fairness, the preservation of the macroeconomic balances of the kingdom and its signature in the international financial markets. In early November, Fitch Rating confirmed Morocco’s BB+ rating with a stable outlook.

Special Lifetime Achievement Award

This special prize is awarded to , 88, a man who has devoted his life to the construction of institutions dedicated to integration such as BIDC, BOAD, Ecobank TI and, most recently, the Asky company. Trained at the Institut des Hautes Etudes d’Outremer and the Institut des Sciences Sociales du Travail at the University of Law and Economic Sciences in Paris, his first position was as Head of the Administrative District of Lomé. Then Director General of the Compensation Fund, Family Benefits and Industrial Accidents of Togo, ancestor of the National Social Security Fund (CNSS). In 1978, he was elected president of the Chamber of Commerce, Agriculture and Industry of Togo. From this post, he will be promoted to the presidency of the Federation of Chambers of Commerce and Industry of West Africa. In 1985, he co-founded the Ecobank Group with Henry Fajemirokun and Adeyemi Lawson. From 1996 to 2003, he was Chairman of the Board of Directors of the banking group and then Honorary Chairman. In 2010, he managed to put Asky on the baptismal font thanks to his lobbying and his leadership.

DEVELOPMENT BANKER OF THE YEAR

Sidi Ould Tah, BADEA

At the head of BADEA since April 7, 2015, Dr Sidi Ould TAH, 58, is leading the radical transformation of the institution. In early April 2022, the bank announced an increase in its authorized capital by 376%, from USD 4.2 billion to USD 20 billion. The focus is now on finance- development of the private sector and support initiatives for SMEs alongside the traditional activities devolved to States and financial institutions. Dr Ould Tah holds a doctorate in economics from the University of Nice-Sophia-Antipolis (France), and a D.E.A in economics from the University of Paris VII. He also holds a diploma in general economic studies, and a master’s degree in economics, from the University of Nouakchott. Dr Ould TAH is fluent in three languages namely Arabic, French and English. The financier began his career as an executive at the Mauritanian Bank for Development and Trade (BMDC) (1984-1986), then as a financial analyst at the Food Security Commission (1986). In 1987, he held the position of Administrative and Financial Director of the Municipality of Nouakchott. In 1988, Dr Ould TAH joined the Autonomous Port of Nouakchott where he served as Advisor to the General Manager and Director of the Internal Audit Department. In 2007 he was appointed Advisor to the Prime Minister, in charge of infrastructure and in July 2008, Minister of Economy and Finance. From August 2008 to April 2015, he served as Minister of Economic Affairs and Development of Mauritania until his election as head of BADEA.

Akinwumi Adesina, AfDB

President of the African Development Bank Group (AfDB) since 2015, Dr. Akinwumi Adesina, 60, has rearticulated the strategic orientations of the pan-African institution around five priority areas, the high fives. The former Nigerian Minister of Agriculture, unanimously re-elected for a second five-year term on August 27, 2020, holds a Bachelor’s degree in Agricultural Economics (First Class Honours) from the University of Ife (now (now Obafemi Awolowo University), Nigeria, in 1981. Dr Adesina is Masters (1985) and PhD in Agricultural Economics (1988) from Purdue University, United States of America, where he won the award for best doctoral dissertation for that year- the. Dr. Adesina was awarded the prestigious Rockefeller Foundation Social Science Fellowship in 1988, which launched him into his international career. With Dr. Adesina at the helm, the African Development Bank Group achieved the largest capital increase since its inception in 1964 when, on October 31, 2019, shareholders from 80 member countries raised the general capital to $93 billion. dollars to a historic $208 billion.

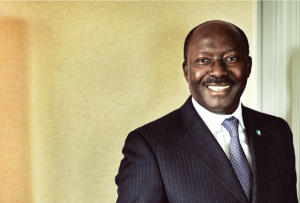

George Donkor, EBID

President of the ECOWAS Bank for Investment and Development (EBID) since February 3, 2020, George Agyekum Donkor, PhD/DBA, has cleaned up the institution’s balance sheet and strengthened its fundraising program. At the beginning of November 2022, the bank approved its capital increase which will increase from 1.5 to 3.5 billion dollars from January 2023. EBID also upgraded its rating with rating agencies Moody’s and Fitch Ratings in 2021 and 2022 from B2 (negative outlook) to B2 with stable outlook, despite the global economic recession induced by the Covid-19 pandemic and the war between Russia and Ukraine. DONKOR, served for seven (7) years as Vice President in charge of finance, administration and institutional services of the Bank.

Ibrahima Cheikh DIONG, Under Secretary General of the United Nations, DG of ARC

Benedict Okey Oramah, Afreximbank

President of Afreximbank since September 2015, Benedict Okey Oramah, 61, has been actively involved in building African integration. After financing the installation of the ZLECA office in Accra (1 billion dollars), the purchase of vaccines by the African Union, the Cairo-based bank launched the pan-African payment and settlement system whose acronym English is PAPSS (pan-African payment and settlement system). the platform should reduce the continent’s dependence on international currencies. Dr. Oramah holds an M.Sc. and Ph.D. in Agricultural Economics from Obafemi Awolowo University, Ile-Ife, Nigeria as well as a B.Sc. degree in Agricultural Economics from the University of ‘Ibadan, Nigeria.

Admassu TADESSE, Trade and Development Bank (TDB Group)

SPECIAL AWARD FOR FEMALE LEADERSHIP

Rose Kayi Mivedor, Minister for Investment Promotion, Togo

The CEO’S OF THE YEAR

Arouna Nikiema, BBS Holding

CEO of Brigade Burkinabè de Surveillance (BBS), Arouna Nikiema, a lawyer by training, is the founder of a company with 11,000 employees in 11 African countries. In the Central African Republic, for example, Croisement SA, a subsidiary of BBS Holding, provides unarmed security missions for the benefit of MINUSCA. Arouna Nikiema is also president of the African Confederation of Private Security Activities (CAAPS) and of the Investors Without Borders (ISAF) network.

Cyrille NKontchou, Enko Capital

Ylias Akbaraly, Redland

Mostafa Terrab, OCP Group

Aliko Dangote, Dangote Group

In 2023, Aliko Dangote should inaugurate the Lekki refinery, a petrochemical complex of 400,000 barrels per day at a total cost of 8 billion dollars, which should reduce Nigeria’s excessive dependence on the outside. This investment, partly financed by debt, is an achievement for the Dangote Group, created in 1981 and evolving since then in an all-out diversification strategy. Initially, Aliko Dangote was an importer of sugar and rice. His experience of acquiring a bank in the late 1980s quickly turned bankrupt. The group builds a cement factory, a sugar refinery and a packaging plant for pasta that will make its fortune. In 2007, Dangote Cement was listed on the Nigerian Stock Exchange (NSE). In June 2013, his fortune exceeds 20 billion dollars. Nine years later, he is still the richest African in the world but must finalize his refinery and monitor his group’s debt.

In 2023, Aliko Dangote should inaugurate the Lekki refinery, a petrochemical complex of 400,000 barrels per day at a total cost of 8 billion dollars, which should reduce Nigeria’s excessive dependence on the outside. This investment, partly financed by debt, is an achievement for the Dangote Group, created in 1981 and evolving since then in an all-out diversification strategy. Initially, Aliko Dangote was an importer of sugar and rice. His experience of acquiring a bank in the late 1980s quickly turned bankrupt. The group builds a cement factory, a sugar refinery and a packaging plant for pasta that will make its fortune. In 2007, Dangote Cement was listed on the Nigerian Stock Exchange (NSE). In June 2013, his fortune exceeds 20 billion dollars. Nine years later, he is still the richest African in the world but must finalize his refinery and monitor his group’s debt.

Strive Masiyiwa, Econet Global

Strive Masiyiwa controls 52.85% of Econet Zimbabwe, the country’s main telecommunications service provider with a presence also in Burundi, Lesotho and Botswana. The billionaire with a fortune valued at $3 billion also owns a 30% stake in EcoCash Holdings, a diversified smart technology company that harnesses digital and financial technologies to establish shared economies and encourage financial inclusion. The telecoms mania stood out during the Covid-19 pandemic by covering the salaries of doctors in his country and by getting involved at the continental level as special envoy to the African Union (AU) on the COVID-19 and Africa Vaccine Acquisition Task Team Coordinator. Since the end of February 2022, Masiyiwa has announced his withdrawal from the board of directors of Econet, a company listed on the stock exchange and more than ever dissociated from the personality of its founder.

Strive Masiyiwa controls 52.85% of Econet Zimbabwe, the country’s main telecommunications service provider with a presence also in Burundi, Lesotho and Botswana. The billionaire with a fortune valued at $3 billion also owns a 30% stake in EcoCash Holdings, a diversified smart technology company that harnesses digital and financial technologies to establish shared economies and encourage financial inclusion. The telecoms mania stood out during the Covid-19 pandemic by covering the salaries of doctors in his country and by getting involved at the continental level as special envoy to the African Union (AU) on the COVID-19 and Africa Vaccine Acquisition Task Team Coordinator. Since the end of February 2022, Masiyiwa has announced his withdrawal from the board of directors of Econet, a company listed on the stock exchange and more than ever dissociated from the personality of its founder.

Hassanein Hiridjee, Axian Group

Of Malagasy and French nationality, Hassanein Hiridjee is a graduate of the Paris Business School (ESCP). He held several positions in the financial sector in France before returning to Madagascar in 1997 to create his own property development company, First Immo. A shareholder in several companies, he bought BNI Madagascar, which previously belonged to the French group Crédit Agricole.

Of Malagasy and French nationality, Hassanein Hiridjee is a graduate of the Paris Business School (ESCP). He held several positions in the financial sector in France before returning to Madagascar in 1997 to create his own property development company, First Immo. A shareholder in several companies, he bought BNI Madagascar, which previously belonged to the French group Crédit Agricole.

Naguib Sawiris, Mancha Fund

Mania telecoms and titular figure of the operator Orascom, the Egyptian billionaire confirms his recent interest in gold mining through the Mancha Fund endowed with 1.4 billion dollars. Based in Luxembourg, the Mancha Fund is specifically focused on the exploitation of gold and metals involved in the energy transition. In November 2022, the fund signed an “expression of interest agreement” with the government of Nigeria, a potential country on the same level as Sudan and South Sudan. Thus, despite his failure in the takeover of 51% of the Egyptian government company Shalateen Mining Company, suspended after nine months of negotiations, Naguib Sawirs firmly believes in it: the future is gold.

Mania telecoms and titular figure of the operator Orascom, the Egyptian billionaire confirms his recent interest in gold mining through the Mancha Fund endowed with 1.4 billion dollars. Based in Luxembourg, the Mancha Fund is specifically focused on the exploitation of gold and metals involved in the energy transition. In November 2022, the fund signed an “expression of interest agreement” with the government of Nigeria, a potential country on the same level as Sudan and South Sudan. Thus, despite his failure in the takeover of 51% of the Egyptian government company Shalateen Mining Company, suspended after nine months of negotiations, Naguib Sawirs firmly believes in it: the future is gold.

Mohamed Vall Ould Telmidi, SNIM Mauritanie

At the head of the National Industrial and Mining Company (SNIM) since March 2022, Mohamed Vall Mohamed TELMIDY has given the public mining company a shift towards the production of green steel. Thus, SNIM signed a memorandum with ArcelorMittal on May 24, 2022, relating to the feasibility study and the establishment of a pelletizing unit to produce green steel with a volume of 2.5 million tons. Former Managing Director of the Mauritanian Hydrocarbons and Mining Heritage Company (SMH PM), Mohamed Vall Ould Telmidi also has extensive knowledge of major issues relating to the mining and oil sectors in Mauritania. A state engineer, since June 2017 he has held the position of Commercial Director of SNIM, in charge of the Company’s commercial and marketing policy. Mohamed Vall Mohamed TELMIDY was previously Director of the Company’s operational offices for six years before becoming Director of the Production Division, in charge of all production and maintenance operations in Zouerate and Nouadhibou. A graduate of the National School of Mineral Industries (ENIM in Rabat, Morocco), he has followed several training courses in business management.

Mahamadou Bonkoungou, EBOMAF Group

Founder of the EBOMAF Group (Entreprise Bonkoungou Mahamadou et fils) Mahamadou Bonkoungou, 56, created Ebomaf in 1988 in general trade. The entrepreneur honed his skills by selling household appliances, investing in gold, then in construction and, later, in air transport with Liza Transport International (Lti), a private jet rental company. Now present in the banking sector through IB Holding, a financial company with a share capital of 30 billion FCFA, the Bonkoungou group bought in 2021 90% of the Togolaisse Bank for Commerce and Industry (BTCI). During the same year, Mahamadou Bonkoungou launched in Djibouti the activities of IB Bank, formerly Banque de l’Habitat du Burkina Faso (BHBF), acquired and renamed in 2018.

Komé Cessé, Koira Holdings

Hotel promoter and investor with the Radisson Blu and the Koira Hotel in Bamako (formerly Sheraton), the Radisson Blu in Abidjan, the Malian Komé Cessé symbolizes perseverance and success through hard work. Self-taught, the former shoe shiner and textile trader began investing in the hotel business in 2002 with Résidence Komé, a 50-room establishment in Bamako built in support of the national effort to host the African Cup of Nations. nations. Renovated and extended, this establishment will become the Radisson Blu with 190 rooms. At the beginning of November 2022, Komé Cessé donated 100 million FCFA to a telethon in favor of the social service of the Malian armies.

Mohamed Abdallahi Ould Yaha, Maurilog

Founding President of Maurilog, a leader in port logistics, Mohamed Abdellahi Ould Yaha made his mark when he bought the activities of the German DB Shenker in 2014. The renamed Mauritania Logistic entity is gaining a foothold in port and oil logistics and investing in a platform that makes it essential today in the port of Nouakchott. Apart from Maurilog, Ould Yaha represents large groups in Mauritania like BP, Petronas and Schlumberger. Speaking Arabic, French, Spanish and English, the graduate of the National School of Mechanics (ENSM), General Delegate for the Promotion of Private Investment between 2007 and 2008, intends to develop his group in the area from the Mediterranean to West Africa.

Bernard Ayitee, Obara Capital

At the head of the hedge fund Obara Capital, the Beninese Bernard Ayitee is regularly talked about in the sub-region as part of the mobilization of funds for the marketing of cocoa and cotton. Formerly at BNP Paribas, this racy investment banker was vice-president of the Corporate and Institutional Banking department of BNP Paribas in Paris before occupying the position of Mergers & Acquisitions Director at KeysFinance Partners in Côte d’Ivoire, then created the African hedge fund Obara Capital in March 2018. During November 2022, he advised the trader Kineden on a record international syndicated loan of 40 million euros.

Sébastien Kadio-Morokro, Petro Ivoire

Sébastien Kadio-Morokro became head of Pétro Ivoire in 2010 when the company had only 150 employees and 28 stations to its credit. Petro Ivoire expanded in 2012, notably with the creation of a butane gas subsidiary within it, in this case the African Petroleum Products Storage Company (SAEPP). Today, the company has 76 stations and 500 employees as well as three storage spheres of 4500 tons of gas. It plans to be accompanied by local entrepreneurs and business leaders in the export of the Ivory label beyond the Ivorian borders, through the takeover of other oil companies. The goal is to compete with oil giants in terms of its competitiveness.

Anta Babacar Ngom, Sedima

Daughter of Babacar Ngom, president and founder of SEDIMA, Anta Babacar Ngom DIACK embodies the next generation of the leading group in poultry farming in Senegal. Under his leadership, Sedima continues its diversification, particularly towards catering with a partnership with KFC. Graduated with a Master 1 in Economics from York University in Toronto and a Master 2 in International Project Management and NICT in Paris, then an MBA in Communication at Sciences Po Paris2, she has the mission of leading the group to new levels by moving it from the status of national champion to that of regional leader.

NET BANKING INCOME (CEO category)

Mohamed El Kettani, President of Attijariwafa Bank

In 2007, he was appointed Chairman and CEO General of Attijariwafa. Mohamed El Kettani has permanently changed this institution from champion of Morocco to champion from Africa. Graduated from ENSTA – Paris Tech, Mohamed El-Kettani is a house manager who has actively participated in the merger between BCM and Wafa Bank, the big bang of banking renewal Moroccan, which will give birth to Attijariwafa Bank at the start of 2004. Today, the Attijariwafa bank group is present in 25 countries in Africa, Europe and the Middle East and has a network of 4306 branches.

Idrissa Nassa, Coris Bank International

Successful self-made man, Idrissa Nassa was in the early 90s in commerce and international trade. From 2000, he embarked on the hotel and real estate business. In 2008, he invested in Financière du Burkina (FIB), an institution then in difficulty. Restructured and recapitalized, the FIB becomes Coris Bank International today one of the first banking establishments in the WAEMU zone. In December 2016, Coris Bank International entered the Stock Exchange (BRVM). In 2022, the bank appeared in the barometer of the African top 30.

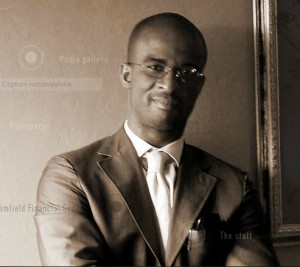

Paul Fokam, Afriland First Bank

Paul Fokam’s career is intertwined with the economic recovery of Africa. In 1986, he founded CCEI Bank, a Cameroonian bank which became Afriland First Bank in 2002. The Afriland First Group holding company based in Switzerland owns the Afriland First Bank banking network in Africa, present in 7 countries. Former lecturer at the Technical Banking Institute of the National Conservatory of Arts and Crafts in Paris, Paul Fokam, teacher of leadership and strategy, founded PK Fokam Institute of Excellence in 2006.

Thierno Seydou Nourou Sy, BNDE

At the helm of the National Bank for Economic Development (BNDE) since 2014, Thierno Seydou Nourou Sy has translated the vision of the sovereign state into banking reality by becoming one of the leading lenders to SMEs in terms of outstanding debt ratios related to GNP. At the end of 2021, BNDE had a total balance sheet of 332 billion CFA francs. The level of credit to customers and microcredit companies stood at CFAF 157 billion. The bank’s third 2022-2026 business plan is articulated around a vision in line with Senegal’s economic development strategies.

Othman Benjelloun, BMCE Bank Of Africa

Second in fortune in Morocco and fifteenth in Africa with $1.9 billion, Othman Benjelloun, 91, bought the insurance company Royale Marocaine d’Assurances (RMA) in 1988. In 1995, he took over Banque Marocaine du Foreign trade thanks to privatization for make him more than 27 years later an African champion. The Benjelloun group revolves around the personal holding O Capital (formerly Financecom), present in banking (BMCE Bank Of Africa), insurance (RMA), telecoms (Orange Morocco), tourism (Risma, Aman Resorts ), media (Soread 2M, Medi1TB), Consulting (Valyans), transport (CTM) and Agriculture (BioBeef, Rwnch Andarouch). Benjelloun’s new challenge is the construction in Salé of the largest tower of the O’Tower company, Morocco. The project being completed is developed by 48% owned by Bank Of Africa.

Henri Claude Oyima, BGFI Group

Brought to the head of the Gabonese Employers’ Confederation (CPG) in mid-2022, Henri-Claude Oyima, 66, is also the CEO of BGFI Holding Corporation SA and Chairman of the Board of Directors of the Stock Exchange of Central Africa (BVMAC). Trained in finance in the USA, at the University of Washington, he obtained his Bachelor’s degree in administration sciences and a Master’s degree in banking. He joined Citibank New York in 1982 then joined the BGFI group (then Paribas Gabon) in 1983. Two years later, he was called to Gabon to be appointed Deputy Managing Director and Head of the Port Gentil branch. The bank, present in 11 countries, plans to go public on the BVMAC in what must be a major event in African finance.

Alain Nkontchou, Ecobank TI

A Cameroonian financier who has made a career in private equity, Alain Nkontchou, 59, has been chairman of the board of directors of the pan-African group Ecobank since mid-2020. In tandem with Ade Ayeyemi, he is one of the executives who have succeeded in instilling growth momentum at Ecobank. Trained in France (at Supelec and then at the Ecole Supérieure de Commerce de Paris), he spent the first part of his career in Europe, particularly in London, with JP Morgan and Crédit Suisse. In 2008, he created Enko Capital Management LLP, an investment company dedicated to Africa and which manages more than 900 million dollars in assets. Alain Nkontchou has worked in several prestigious brands such as JP Morgan, Global Macro Trading and BlueCrest Capital Management.

Diane Karusisi, Bank of Kigali (BK)

Diane Karusisi, 45, has been the managing director of Bank of Kigali (BK), Rwanda’s largest commercial bank by assets, since 2016. Holder of a Masters in Econometrics and a Doctorate in Quantitative Economics from the University of Friborg (Switzerland), she worked as Chief Economist and Director of Strategy and Policy in the Office of the President of Rwanda. From 2000 to 2006, she was assistant professor of economic statistics at the University of Fribourg, Switzerland. From 2007 to 2009, she worked at Credit Suisse Asset Management in Zurich, as a bond portfolio engineer. In August 2009, she returned to Rwanda and was appointed Senior Advisor to the Director General of the National Institute of Statistics of Rwanda (INSR), Kigali.

Koné Dossongui, Atlantic Financial Group

Koné Dossongui continues its spectacular comeback after the takeover in 2019 of the former CIC and Barclays in Côte d’Ivoire and of the former Amity Bank which became Banque Atlantique du Cameroun and, in 2020, of 3 BNP subsidiaries, namely the International Bank for Commerce and Industry in Mali (BICIM), the Bank for Industry and Commerce in the Comoros (BICC) and the International Bank for Commerce and Industry in Gabon (BICIG). Three years after this three-way snooker, the businessman advised by a limited staff led by Léon Koffi Konan, in charge of International Strategy, obtained approval in Madagascar through Atlantic Financial Group (AFG) . The bank will be called AFG BANK MADAGASCAR. A banking license is also expected for Côte d’Ivoire. AFG will be the first banking group in sub-Saharan Africa to be present in 3 regions, namely West Africa, Central Africa and the Indian Ocean.

Ferdinand Ngon Kemoum, Oragroup

Ferdinand Ngon Kemoum is Managing Director of Oragroup SA, Holding of the Orabank banking group, present in West and Central Africa. He was previously Managing Director and partner at Emerging Capital Partners, the first American investment fund to have raised and invested more than $3 billion in Africa. He was also the Chairman and CEO of FINADEV Africa Holding, a microfinance group. Previously, Ferdinand Ngon Kemoum held management positions in several banks (Amity Bank Cameroon, LOITA Capital Partners International, Banque Continentale Africaine Rwanda) and investment funds, notably as Managing Director of Framlington Asset Management Central Africa growth Fund , a fund dedicated to CEMAC (Economic and Monetary Community of Central Africa). The Orabank group is present in 12 countries in West and Central Africa (Benin, Burkina Faso, Ivory Coast, Gabon, Guinea Conakry, Guinea Bissau, Mali, Mauritania, Niger, Senegal, Chad and Togo) and in four monetary zones (UEMOA, CEMAC, Guinea Conakry and Mauritania). With 166 bank branches, a management and intermediation company (SGI) and 2,080 employees, the group offers more than 500,000 customers a wide range of banking and financial products and services according to the principles of proximity and responsiveness.

Mustafa Rawji, Rawbank

Born in Kinshasa, Mustafa Rawji completed his secondary studies in London and obtained a master’s degree in finance in Boston (Babson College). He began his career at Calyon Bank, first in Geneva, then in Paris. In 2002, he accompanied the creation of RAWBANK. Two years later, he took the initiative to acquire additional international banking experience and joined HSBC in Dubai, where he worked for five years as a commercial executive in the Corporate, Investment & Merchant Banking department. In September 2009, he joined RAWBANK as Deputy Secretary General. He successively held the positions of Chairman of the Credit Committee, Head of the Marketing & Communication Department and Chairman of the Quality Committee. At the end of 2013, he was appointed Director of Strategic Development and, in 2014, Vice-Chairman of the Management Committee. In July 2015, he was appointed Deputy Managing Director in charge of support and infrastructure. He was appointed Chief Executive Officer of Rawbank in 2020.

Dr Leila Bouamatou, Générale de Banque de Mauritanie (GBM)

After a university career that took her to Switzerland, Tunisia, Spain and the United States, Dr. Leila Bouamatou returned to Mauritania to manage her father’s bank, Générale de Banque de Mauritanie. She made her debut in 2009 as head of the Treasury of the General Bank of Mauritania (GBM). For five years, Leila Bouamatou has been Administrator and General Manager. A woman of temperament, she was able to restore this leading bank to its former glory. Winner of the “Banker of the Year” award from the Financial Afrik Awards in 2021, Leila Bouamatou knows it, she must make a name for herself in a conservative Aabe and African universe.

Mamadou Bocar Sy, Banque de l’Habitat du Sénégal

Managing Director of the Banque de l’Habitat du Senegal (BHS), Mamadou Bocar Sy is a long-term banker. His career began in the Credit Department of the Banque de l’Habitat du Sénégal in 1988. For 10 years, he developed strong expertise in financial analysis and modeling and mastered the various real estate financing instruments. In 1998, he joined the Senegalese subsidiary of BNP Paribas, BICIS as Deputy Director of the Department of Individual and Institutional Customers, in charge of the Real Estate Financing division and thus participated in the development of strategies and development plans for the subsidiary’s real estate activity. It was in 2004 that the first Real Estate Department was born within a universal bank in Senegal and it was only natural that the decision to entrust it with the reins was taken. He also sat on the BHS Board of Directors on behalf of BICIS before returning in 2006 as Deputy Managing Director. It accentuates the operational strength of the BHS, initiates projects to improve the quality of service and strengthens the proximity of the BHS with the promoters.

James Mwangui, Equity Bank

James Mwangi, 60, is the current Group Managing Director and Group Chief Executive of Equity Group Holdings Plc, the banking conglomerate with 14 million customers as of December 2019. Founding Chairman of Kenya Vision 2030 Delivery Board from 2007 to 2019, tasked with ensuring that Kenya becomes a middle-income country with a high standard of living by 2030, He is a member of the National Presidential Task Force on Kenya’s COVID-19 Emergency Response Fund . and chairman of its health committee. Mwangi is also the current Chancellor of Meru University College of Science and Technology. Recently, the bank set up 3 million dollars to create a social housing and agricultural program, the Equity Bank sustainable program.

African Integration Multi-Risk Insurance (CEO Category)

Paul Hanratty, Sanlam

CEO of Sanlam, the leading insurance group in Africa, Paul Hanratty has been in the financial sector for 198 years in South Africa, the rest of Africa, the United Kingdom and elsewhere. He was appointed Group Chief Executive of Sanlam on July 1, 2020 and has been a member of the Board of Directors since 2017. He has been an independent non-executive director of MTN since 2016 and is the non-executive chairman of Intelligent Debt. Beyond the positions he holds in some of the most successful companies in the country, Paul is also a Fellow of the Institute of Actuaries (FIA).

Jean Kacou Diagou, NSIA

Jean Kacou DIAGOU, 76, graduated from the National School of Insurance in Paris in 1972, first proved himself as an employee. Thus, in 1981, he was Director General of the African Union, a subsidiary of the UAP. In 1992, he was appointed director and vice-president of the African Union group. In 1995, he founded the New Inter-African Insurance Company (NSIA). A year later, the NSIA acquired the Ivorian subsidiary of Assurance Générale de France sur ledépart. Today, the NSIA has 32 subsidiaries in 12 countries and operates in insurance and banking.

Richard Lowe, Activa

Founder of the Activa company in 1998, Richard Lowe, a graduate of ESSEC Paris, is a former executive of the Cameroonian subsidiary of the AGF Afrique group. In 1996, he resigned and founded his group two years later. In 2002, the group launched Activa Vie anticipating what would be the big wave of the decade. Activa now has 7 subsidiaries in six countries: Cameroon, Ghana, Conakry, Liberia, Sierra Leone and DRC. Activa is also a member of the Globus network (commercial platforms in Paris and Douala), based on common standards and quality service. Present today in 37 countries, this platform has been reinforced since 2011 with Globus Ré, the reinsurance company of the network whose objective is to offer traceability in terms of reinsurance coverage for international partners and customers.

Maïmouna Barry Baldé, NSIA Assurances Guinée

(Next generation) Managing Director of NSIA Assurances Guinea since 2021, Maïmouna Barry Baldé oversees all of the Group’s insurance activities in Guinea. Maïmouna Barry Baldé has 15 years of experience in the financial and insurance sector. She joined the NSIA Group in 2015 as Deputy Managing Director of NSIA Assurances Guinea, before taking up the position of Managing Director of the new subsidiary NSIA Vie Assurances Guinea since September 30, 2019. Previously, she held the position of Managing Director Financier of the Congolese subsidiary of Bank of Africa (BOA) and worked in financial audit for the firm PwC in Guinea in the Democratic Republic of Congo. Maïmouna Barry is a graduate of the Higher Institute of Commerce and Business Administration (ISCAE) in Casablanca.

Loïc KENGNE WAFO, Director of SAAR Assurances Côte d’Ivoire

(Next generation) Holder of a Master’s degree in Law and an MBA in INSURANCE, Loïc KENGNE WAFO, 30, joined the insurance sector as account manager and then in charge of compliance within the SAAR ASSURANCES group in Cameroon. Today, at 30, the Managing Director of SAAR ASSURANCES and SAAR VIE in Côte d’Ivoire, the leading market in the CIMA zone, is recognized by his peers. His great achievement was undoubtedly the launch of the very first TAKAFUL insurance window in the Republic of Guinea. This product has recruited 50,000 customers. Also among his achievements, the launch of a Mobile insurance agency in Conakry.

The BARONS OF THE FINANCIAL MARKETS (CEO CATEGORY)

Leila Fourie, Bourse de Johannesburg (JSE)

Dr Leila Fourie is the group CEO of the Johannesburg Stock Exchange (JSE), the largest stock exchange on the African continent with 80% of its market capitalization. Dr Fourie is responsible for developing and executing the JSE’s corporate strategy ensuring that the South African financial center remains a competitive exchange and a platform for growth and access to capital. Leila sits on the board of numerous corporate boards in South Africa, including CSD Strate and Business Leadership South Africa. Leila is also Co-Chair of the UN Secretary General’s Committee – Global Investors for Sustainable Development (GISD).

Nezha HAYAT, Moroccan Capital Market Authority (AMMC)

President of the Moroccan Capital Market Authority since 2016 and Vice-President of the Africa and Middle East Regional Committee (AMERC) of the International Organization of Securities Commissions (IOSCO), Ms. Nezha HAYAT is a graduate of ESSEC Paris. Her career began at Banco Atlantico (Spain) in the international division as head of international risks and restructured debt portfolio (1985-1988).From 1988 to 1990, she held the position of corporate finance manager in two brokerage firms in Madrid (Inverfinanzas, then Bravo y Garayalde). In 1990, she was a bank director at Banco Inversion in Marbella and in 1993, deputy director of the offshore unit of the Banque Nationale de Paris in Tangier. She then joined Société Générale Marocaine de Banques in October 1995 and launched its asset management and stock market intermediation activities, following the reform of the capital markets in Morocco and the privatization of the Casablanca. In 1999, she was elected president of the Association Professionnelle des Sociétés de Bourse (APSB). Distinguished Global Leader for Tomorrow by the World Economic Forum in Davos in 2000, Nezha Hayat is one of the founders of the Moroccan Association of Women Entrepreneurs (AFEM) in 2000. Nezha Hayat was decorated with the Wissam Al Arch category officer by His Majesty King Mohammed VI. In 2019, she received the decoration of Commander of the Spanish Civil Merit Order.

Bilel Sahnoun, Tunisian Stock Exchange

An engineering graduate from the Ecole Centrale de Lyon and an MBA from the Mediterranean School of Business, Bilel Sahnoun began his career in 1990 with Union Bancaire pour le Commerce et l’Industrie (UBCI), a subsidiary of the BNP – PARIBAS Group where he rose through the ranks of the general inspection of large companies. Since February 2015, he has been Managing Director of the Tunis Stock Exchange (BVMT). Under his leadership, the financial center has set up a capital market place committee, including the CMF, the AIB, and Tunisie Clearing. Also under his direction, the launch of a financial market regulatory reform mission with the support of the EBRD, the access of the BVMT to the status of full member of the World Federation of Exchanges (WFE ), the upgrading of Tunisia’s rating with the main international index providers FTSE and MSCI, the launch of a stock market and capital market perception study in collaboration with the Konrad Adenauer Foundation (KAS) and the establishment of an MOU with NASDAQ DUBAI for the issuance of Sukuks by Tunisia.

Obaid Amrane, Moroccan Sovereign Fund Ithmar

The CEO of the Moroccan sovereign wealth fund of Ithmar Capital, Obaid Amrane, has been since June 2022, leader of the African Forum of Sovereign Investors. Objective, explore investment opportunities and mobilize more capital for the benefit of the African continent and its development. An agricultural engineer from the Hassan-II Agronomic and Veterinary Institute, Obaid Amrane went through the Finance Inspectorate, the Treasury Department, before landing in 2010 at MASEN (Solar Agency) as a member of the management board.

Dr. Felix Edoh Kossi Amenounvé, BRVM

At the head of the Regional Securities Exchange (BRVM) of the West African Economic and Monetary Union (UEMOA) since October 2012, Felix Edoh Kossi Amenounvé, 55, also outgoing president of the African Securities Exchanges Association (ASEA ), is one of the activists of the interconnection of African financial centers. Under his leadership, ASEA obtained the launch of the AELP Link interconnection platform on November 18, 2022, with the membership of 7 stock exchanges. Namely, the Regional Stock Exchange (Brvm), Casablanca stock exchange (Cse), The Egyptian exchange (Egx), Johannesburg stock exchange (Jse), Nairobi securities exchange (Nse), Nigerian exchange limited (Ngx) and the Stock Exchange of Mauritius (Sem).

Abena Amoah, Ghana Stock Exchange

Brought to the Ghana Stock Exchange (GSE) in mid-October 2022, Abena Amoah has a wealth of experience of over 24 years in the financial markets industry including in stock market listings and transactions, M&A advisory, investment research, asset management, private equity placement, etc. Ms. Amoah takes office at a time when the Exchange is implementing two major programs: a three-year strategic plan to move from a frontier market to an emerging market; and the demutualization of the Exchange, a strategic transition that will result in a group of related companies, including a limited liability company to manage market operations and a company limited by guarantee to undertake public education activities and other market development activities.

Said Ibrahimi, Casablanca Finance City Authority (CFCA)

Managing Director of Casablanca Finance City Authority (CFCA), Saïd Ibrahimi has made Casablanca Finance City the first business community with an African vocation. More than 200 companies are now members of CFC. A graduate of the Ecole Centrale (economics option, 1981), Saïd Ibrahimi has spent his entire career in banking and the senior civil service. An executive at BNP in Paris, then at the Moroccan subsidiary BMCI, he was Managing Director of the Moroccan Bank for Africa and the Orient (BMAO) then of the Caisse Nationale de Crédit Agricole (CNCA). In 2003, he was appointed general treasurer of the kingdom.

Nguéto Tiraina Yambaye, FAGACE

In office since 2020, Nguéto Tiraina Yambaye is continuing his reform program in order to strengthen the activities of the African Guarantee and Economic Cooperation Fund (FAGACE). The institution today brings together 14 countries of intervention, around fifty partner financial institutions and presents more than 400 billion CFA francs in commitments and more than 2,000 billion CFA francs in credits mobilized for the benefit of the economies of its States. members. An economist with 25 years of experience at the international and national level, Nguéto Tiraina Yambaye was notably Minister of Economy, Planning and Development in his country, Chad, and Administrator of the IMF.

THE FINANCIAL OF THE YEAR

Serge Ekué, BOAD

President of the West African Development Bank (BOAD) since August 2020, Serge Ekué, 56, is a long-term financier. From 2016 to 2020, he led Natixis’ Corporate and Investment Banking (CIB) activities for the United Kingdom in London. He combined this responsibility with that of Market Solutions for Europe, the Middle East and Africa (EMEA) and Director of the Africa and Russia Department for Global Banking. A recognized expert in Financial Markets and Capital Markets, Serge led Natixis’ Markets Activities for the Asia-Pacific region for nearly six years (2010-2016) before assuming the General Management of the bank based in Hong- Kong. Serge Ekué holds an Executive MBA from HEC Paris, a DESS in Banking and Finance from Paris V and a diploma from the Institute of Political Studies in Bordeaux.

Sim Tshabalala, Standard Bank

Sim Tshabalala joined the group in 2000 within the project finance division of SCMB and in 2001 he was appointed to the group’s executive committee. Between 2001 and 2006 he was Managing Director of Stanbic Africa, and in 2006 was appointed Managing Director of PBB. In June 2008, he was appointed Managing Director of SBSA, a position he held until January 2018. In March 2013, he was appointed Joint Group Managing Director of SBG, alongside Ben Kruger until September 2017, when he took over as the group’s sole managing director. Standard Bank posted record overall profit of R15.3 billion for the six months to June 30, 2022, up 33% from the prior period. The Group intends to soon set up in Morocco and Egypt.

Kamal Mokdad, Banque Centrale Populaire, Maroc

Kamal Mokdad, 48, Managing Director of Banque Centrale Populaire in Morocco, in charge of management and international development, has piloted the institution’s latest acquisitions since 2018. The latest deal from the number two in the banking sector dates back to 2019 with the acquisition of three banks, notably in the Democratic Republic of Congo (DRC), Mauritius and Madagascar, thus bringing the number of countries in which Banque Populaire is present to 18. A supporter of African integration, Kamal Mokdad is also chairman of the board of directors of the Casablanca Stock Exchange.

Dr. Frannie Leautier, Southbridge

Dr. Frannie Léautier, 56, Partner and Vice President of SouthBridge Group and CEO of SouthBridge Investments, worked for 15 years at the World Bank Group (WBG). She was chief of staff to the president and vice-president there for seven years. Dr. Frannie Léautier was Senior Vice President and Chief Operating Officer at the African Development Bank (AfDB). Subsequently, she held several senior positions within the Trade and Development Bank (TDB) group, including Vice Chairman of the Board, Special Advisor to the Chairman, before becoming the first Chief Operating Officer of TDB and directing the bank’s asset management business. In early November 2022, SouthBridge Investments partnered with the Arab Bank for Economic Development in Africa (BADEA) to announce the creation of a $2 billion fund for landscape and forest restoration in Africa.

Simon Tiemtoré, Vista

A former executive of Afreximbank, Simon Tiemtoré created the Lilium Capital investment fund based in New York. In 2015, the fund acquired the struggling First International banking group, which it spun off into Vista Bank. After taking over the BNP Paribas subsidiaries in Burkina Faso and Mali, Simon Tiemtoré is in the running to take over Oragroup, a systemic West African banking group.

Dr. Slim Feriani, Djibouti Sovereign Fund (FSD)

With 33 years of international experience in the financial markets (stock and bond markets) and banking, Tunisian Dr Slim Feriani, 57, has been Managing Director of the Djibouti Sovereign Fund since November 2021. The former Tunisian Minister of Industry, Energy, Mines, Renewable Energies and SMEs (2017-2020), chose to make the sovereign fund’s first investments in Djibouti Telecom (of which he is Chairman of the Board of Directors), a strategic operator in a country crossed by 8 major submarine cables. The other interest of the FSD relates to the management of 60% of the resources of the Social Security Fund. Similarly, the sovereign wealth fund owns 40% of the Great Horn Investment Holding (GHIM), which includes 27 countries. Dr. Feriani holds an MBA (Master in Business Administration) and a Ph.D. (American State Doctorate) in finance, investment and international finance from George Washington University in Washington D.C., where he taught courses in these specialty areas and later served on the advisory board of its School of Business.

Yerim Sow, Teyliom

Over the 2021-2022 interval, businessman Yerim Sow, 55, continued to develop his activities as a promoter of the banking and hotel sector. On the first pole, Bridge Bank Group Côte-d’Ivoire (Bbg-Ci) of which he is the majority shareholder, is established in Dakar. The banking group launched in 2006 got a boost from the IFC, a subsidiary of the World Bank. In the hotel sector, Noom Hotel, with 1,500 employees and a fleet of 795 rooms, is continuing to develop its hotel brands, which cover all ranges from 3 to 5 stars.

ASSET MANAGER AND BROKER OF THE YEAR

Marc Kamgaing, Harvest

With 241 billion FCFA of assets under management at the end of 2021, and 70% market share in the CEMAC (Economic and Monetary Community of Central Africa) zone, the company led by Cameroonian Marc KAMGAING is the leader in the zone. “We have the widest range of investment products on the market with 5 FCPs including 4 with guaranteed capital”, explains the founder. Created in 2017, HARVEST ASSET MANAGEMENT is the very first independent portfolio management company in Cameroon, approved by COSUMAF (financial market supervisory authority) and active throughout the CEMAC zone. In 2022, the asset management company multiplied its capital by 2.5 to bring it to 500 million CFA francs.

Marie Odile Sene Kantoussan, CGF Bourse

At the head of the CGF Bourse, a leading brokerage firm in the regional financial market, Marie Odile Séne and her team of seasoned financiers line up several feats of arms. Over the last five years, CGF Bourse justifies brokers having carried out the largest volumes of transactions. In April 2022, CGF Bourse arranged and closed a sukuk of 330 billion CFA francs for the benefit of the State of Senegal, a record operation in the West African zone (UEMOA). Beyond the direct animation of the market, CGF Bourse is currently participating in the establishment of a popular savings fund in Senegal aimed at mobilizing 1000 billion FCFA from nationals. With 23 years of experience, Marie Odile Sene is convinced that financial education is the cornerstone of better financial inclusion. Hence the “EducFinance” program launched in partnership with Financial Afrik.

Jean-François Brou, SOAGA

Jean-François Brou, SOAGA The West African Asset Management Company (SOAGA) has net assets under management exceeding 100 billion CFA francs. Under the impetus of its managing director, Jean-François Brou, in office since 2014, the institution affiliated with BOAD continues its ascent. Holder of a master’s degree in Economics and Financial Engineering and another master’s degree in Market Activities and also a winner of the Strategic Business Unit Management program at HEC, Mr. Brou first honed his skills internationally, at Natixis in as a young analyst, then at Amundi as an assistant portfolio manager before taking up the position of Team Leader in Interest Rate Derivatives at STATE STREET GLOBAL ADVISORS. Once back on the continent, he will first assume the position of Managing Director at ECOBANK ASSET MANAGEMENT before taking over the management of SOAGA.

Kadidiatou Fadika-Coulibaly, Hudson & Cie

At the head of SGI Hudson & Cie (Hudson), the oldest independent brokerage firm in the Regional Financial Market, Kadidiatou Fadika-Coulibaly began his career with this institution in 1998 as a research officer in the management of the ‘financial engineering. Holder of several degrees, including an MBA from Howard University, she has maintained Hudson’s position in the forefront of the most active intermediaries by volume of transactions. Hudson offers a wide range of services in Stock Brokerage, Investment Banking, Analysis and Research as well as Asset Management.

Ababacar S Diaw, Impaxis Securities

Ababacar S Diaw leads the Impaxis Group where he distinguished himself in 2021 and 2022 by arranging the two largest corporate issues on the market for the benefit of Sonatel and BIDC. Expert in Financial Engineering with more than twenty years of experience in Corporate and Investment Banking (BFI) activities with expertise in M&A, Ababacar has arranged several transactions, financial arrangements and fundraising with clients involved in the Energy, Financial Services, Consumer Goods, Retail, Telecommunications and Real Estate. He has covered through his experiences Europe, the Middle East and Africa with comprehensive expertise in both Advisory and Capital Markets investment banking operations. Before joining the Impaxis Group in 2012, Ababacar was an investment banker in the Mergers & Acquisitions department of HSBC in Paris, France.

Christian DIN DIKA, Emrald Securities Services (ESS)

Emrald Securities Services (ESS) is a multi-business financial group founded by Christian DIN DIKA, a known financier. ESS’s main businesses cover financial advice, financial intermediation, account keeping and management, and asset and wealth management. A former member of Africa Bright Securities and Attijari Securities Central Africa (ASCA), Christian Din Dika worked for nine years at the Douala Stock Exchange.

THE GREEN DEAL OF THE YEAR

Patrick V. Verkooijen, GCA

Head of the African Climate Initiative, Patrick V. Verkooijen is the CEO of the Global Center on Adaptation, a very active Dutch climate foundation. In this role, he works closely with Ban Ki-moon, architect of the Paris Agreement as the 8th Secretary General of the United Nations and Chairman of the Board of GCA. Last September, the GCA committed to the Africa Adaptation Acceleration Program (AAAP), which aims to mobilize $25 billion for the climate.

Akim Mohamed Daouda, FGIS

The Gabonese Strategic Investment Fund (FGIS) led by Akim Mohamed Daouda became in June 2022 the first African sovereign wealth fund to join the net zero asset owner alliance created by the United Nations. With close to $2 billion in assets under management, FGIS aims to achieve net zero greenhouse gas emissions across its portfolio by 2050, set milestones every five years and submit an annual monitoring report. Gabon, which has 88% of its territory covered by forests, absorbed 187 million tonnes of CO2 between 2010 and 2018. In its future projects, the FGIS plans to launch a sovereign green bond between 100 and 200 million dollars. The proceeds of the operation will finance the construction of hydroelectric power stations in the country. In December 2022, the Façade Maritime du Champ Triomphal (FMCT), a subsidiary of the Gabonese Fund for Strategic Investments (FGIS) and Africa Bright Development, a subsidiary of the independent investment bank Africa Bright Group, entered into a partnership for the construction of two eco-responsible buildings on the site of the Baie des Rois, maritime city center of the Gabonese capital.

Alain Ebobissé , Africa 50

The Africa 50 fund led by Alain Ebobosio brings innovations in the field of infrastructure dedicated to renewable energies. In 2019, alongside Scatec and Norfund, Africa50 financed six power plants at the Benban solar park in Egypt. At the time, it was the largest solar power plant in the world to use bifacial technology which captures light from both sides of the panel. And recently, this project benefited from a refinancing which was the first green bond issued for non-recourse infrastructure financing in Africa. Similarly, in Cameroon, Africa50 has invested in the Nachtigal power plant, currently under construction. It is the largest predominantly privately owned hydropower plant in Africa. This project, the total cost of which is estimated at 1.2 billion euros, was financed with equity by the partners and no less than 11 international financial institutions and 4 local commercial banks, including Attijariwafa Bank, participated in it.

Jules Ngankam, AGF

The African Garantee Fund (AGF) and the Nordic Development Fund (NDF) were one of the first institutions to issue green guarantees whose objective is to encourage African financial institutions to invest in the transition ecological by financing SMEs that carry out low-carbon innovations. The coverage of green guarantees can derogate from AGF’s traditional rule of intervention based on balanced risk sharing (maximum coverage of 50% of financing) and reach 75% of financing depending on the expected social and environmental impact of the project to be financed. The guarantee products offered fall into three categories: loan guarantees, invested capital guarantees and resource raising guarantees.

Paulo Gomes, Panafrican Conservation Trust Fund

Paulo Gomes is at the helm of the Panafrican Conservation Trust Fund (PCTF) in the process of being set up with a target size of 2 billion dollars. This fund is intended for the conservation of protected areas in Africa. The innovative structure reconciles Paulo Gomes with green finance, he who sat on the first board of directors of the Green Climate Fund (GCF). As a reminder, “Africa has 6 million hectares of protected areas”, explains Paulo Gomes, former executive director at the World Bank. Panafrican Conservation Trust Fund will have as technical partner Africa Wild Foundation chaired by former Ethiopian Prime Minister Haile Mariam Dessalegn. The first announced contributor to the fund is a certain Paul Kagame, President of Rwanda. In addition to Paulo Gomes, the PCTF fund has in its steering committee, in addition to the former Prime Minister of Ethiopia, the former President of the AfDB, Donald Kaberuka, co-founder of Southbridge.

THE DEAL OF THE YEAR

Naoufal Bensalah, Africa Bright Securities (ABS)

A rising financial company in Central Africa, Africa Bright Securities (ABS) has completed a prosperous year with, in particular, the role of leader in the operation of the IPO of the Gabonese SCG-Ré, a first, alongside others significant operations. Thus, the company headed by Naoufal Bensalah successfully carried out the first green bond issues in the CEMAC zone on behalf of the Gabonese company Façade Maritime du Champ Triomphal (FMCT). The operation related to two “FMCT 2021-2026” green bond loans, for a total amount of 20,000,000,000 (Twenty Billion), remunerated at the annual rate of 7.50% gross over a period of 5 years, including 2 deferred in capital.

Pathé Dione of the SUNU Group in the takeover of BICIS

The Sunu Group of the very discreet Senegalese financier Pathé Dione signed an agreement at the end of July 2022 for the acquisition of 54.11% of the shares of the French BNP Paribas in the International Bank for Commerce and Industry of Senegal (BICIS), a subsidiary Senegalese. This strategic operation, which follows the acquisition of a bank in Togo and 5 Allianz subsidiaries in Africa, makes the group one of the next leaders in bancassurance in the CIMA zone. SUNU Group is a pan-African financial services group. It is present in 17 countries in West and Central Africa. With around thirty companies, including 9 life insurance companies, 17 non-life insurance companies, 1 bank, 1 microfinance company, 2 health management companies, the Group has been the leader for several years in life insurance in French-speaking sub-Saharan Africa. It offers life insurance solutions, property and casualty insurance, banking products and services, health management and asset management solutions.

Jean-Luc Konan in the takeover of the Caterpillar network

At the head of a consortium, businessman Jean-Louis Konan, founder of Cofina, took over Caterpillar dealership activities in mid-November, including the JA Delmas entity and the Network of African Companies ensuring the sale and after-sales in 11 West African countries. At the end of the operation, Jean-Luc Konan was appointed by Caterpillar as the new dealer in the region. In 2013, Jean-Luc Konan created the COFINA Group, an accredited mesofinance institution, leader in West and Central Africa in the financing of Small and Medium Enterprises. The COFINA Group is present in 9 countries (Senegal, Ivory Coast, Burkina Faso, Mali, Guinea, Togo, Gabon and Congo with a representative office in France) and employs nearly 1,500 people.

The BNI, CNPS, IPS-CGRAE, CDC-CI consortium in the takeover of BICICI

In September 2022, Youssouf FADIGA, CEO of the BNI, at the head of a consortium comprising Charles Denis KOUASSI, Director General of the CNPS, Abdrahamane T. BERTE, Director General of the IPS CGRAE and Lassina FOFANA, Director General of the CDC-CI has concluded the agreement to take over 67.49% of BICICI from the BNP Paribas Group (59.79%) and Proparco (7.70%). The public consortium thus formed expresses the ambition of the State of Côte d’Ivoire to constitute a solid banking center to support the State in its development policy. The operation, which remains subject to the green light of the regulators and to the appreciation of the market, makes the directors mentioned above personalities to follow in 2023.

Cheikh Sanankoua, Managing Partner HC Capital for the first green bond by private placement in West and Central Africa

In August 2021, HC Capital Properties, a private investment and development company, initiated the first private initiative green bond issue in Francophone West and Central Africa. This exclusive program is produced for the benefit of Emergence Plaza, the company that owns the Cosmos Yopougon complex. Issued at a rate of 7.5% over 8 years, the funds, worth 10 billion CFA francs, will be used to refinance a loan from a local bank and support the development of the company by strengthening its resources. financial and operational. In a context where the African continent represents less than 1% of green bonds issued annually worldwide, this historic transaction sends a strong signal both to investors and to local companies keen to align their ecological and commercial objectives through alternatives. sustainable funding. HC Capital Properties plans to issue other green bonds to finance the development of new commercial complexes in French-speaking West and Central Africa.

AfricInvest for its exit in Bridge Group West Africa for the benefit of Teyliom Finance

In July 2022, the two funds AfricInvest II LLC and AfricInvest Financial Sector Fund Ltd exited their investment in Bridge Group West Africa “BGWA”. This successful exit after 8 years of presence, illustrates a prosperous year. In May, the Tunisian fund raised $411 million through AfricInvest Fund IV, a historic amount for the private equity firm. As a reminder, the AfricInvest III fund closed in 2016 at 272 million euros. AfricInvest was founded by three partners including Aziz Mebarek (photo), a graduate of the Ecole Nationale des Ponts et Chaussées (Paris). To date, AfricInvest manages €1.5 billion across 18 funds and enjoys strong, long-term support from local and international investors, including leading development finance institutions in the United States and Europe.

Alberto Calderon, CEO of AngloGold Ashanti for his USD 250 million green bond

AngloGold Ashanti, a South African mining company headed by Alberto Calderon, announced in October its intention to issue a green bond of USD 250 to 300 million in the near future to finance its decarbonization projects in Africa and around the world. This initiative is part of the reduction of its greenhouse gas (GHG) emissions by 30% by 2030. To achieve its objectives, the mining giant has indicated that it will be based on the use clean energy intensive to supply electricity to its gold mines located in Africa and elsewhere in the world. The company has indicated that it will continue to reduce its carbon footprint, while improving the productive value of its subsidiaries.

ECONOMIST OF THE YEAR

Author of the book “Being a billionaire in Africa today” (African Presence), Michel LOBÉ EWANÉ evokes the history of wealth in Africa, “as old as that of humanity”. “This story was written in particular by King Mansa Moussa who reigned at the beginning of the 14th century over the Mali Empire. He is considered the richest man of all time. His reign highlights how wealth and fortune are realities that have meaning, symbolism and history in Africa. Today, as more and more wealthy African businessmen and women reshape, transform and build the African continent by creating jobs, their image and legitimacy are often questionable. In “Being a billionaire in Africa today”, Michel Lobé Ewané chose to do them justice, through testimonies and surveys carried out with these personalities from the world of finance, mining, telecommunications and industry. Former editor-in-chief of the magazine Forbes Afrique, the Cameroonian journalist has had a long experience acquired in particular at the BBC in London where he worked for ten years, at TV5 Monde in Paris and at Mutations, a Cameroonian daily for which he was the Director General. Today managing director for Africa of the American financier Joseph Sassoon Group, he also serves as adviser to Sheikh Ahmed Bin Faisal Al Qassimi of Dubai.

Mohsen Abdel Fattah, co-author of the book “The Economics of Sport in Africa”

Kako Nubukpo, Togo

Togolese Kako Nubukpo is unanimously named “Economist of the Year” by the jury of Finacial Afrik. A choice echoing his many initiatives, publications and work on African economies. His latest book, published in October by Odile Jacob in Paris, advocates ecological protectionism capable of encouraging local transformation. “Africa is subject to a gigantic challenge: to integrate in one generation 1 billion additional individuals in a context of low productivity, virtual absence of industry, accelerated urbanization, all topped by a climate crisis that has become permanent. “, we read in the cover page of the book. This “African emergency” requires inventing a new economic model, explains the author. Because Africa has too often been a guinea pig continent, subject to all kinds of predation. The unexpected behind closed doors of the Covid-19 crisis allowed him to rediscover the richness of his heritage. Armed with this lesson, it must now reinvent its development by relying on its common goods. Putting in place an African neo-protectionism and preserving its own resources (land, digital goods, etc.), ensuring its sovereignty – food by developing agroecology, monetary and financial with the creation of a debt agency – are all avenues for Africa is reclaiming its destiny. As a reminder, Kako Nubukpo is Commissioner in charge of the Department of Agriculture, Water Resources and the Environment of the West African Economic and Monetary Union (UEMOA). The author of L’Urgence africaine (Odile Jacob, 2019) was Minister in charge of Prospective and Public Policy Evaluation in Togo (2013-2015).

Lionel Zinsou, Southbridge

Lionel Zinsou, 68, is undoubtedly one of the best current analysts of the African macroeconomic context. Nephew of former Beninese President Émile Derlin Zinsou, a graduate of the École Nationale Supérieure (France), he had a career in banking, at the investment bank Rotschild then at PAI Partners. After a brief interlude in Beninese political life as Prime Minister Lionel Zinsou returns to business and launches SouthBridge Bank with Donald Kaberuka, former President of the African Development Bank.

Carlos Lopes, Economist

From 2012 to 2016, Carlos Lopes was Executive Secretary of the Economic Commission for Africa (ECA), giving this institution a focus on issues of integration and industrialization of Africa. Author of more than 25 books and essays on African economies, Carlos Lopes has been awarded three times as best African economist by Financial Afrik. Carlos has served in several institutions and foundations such as the Kofi Annan Foundation, the UNESCO International Institute for Educational Planning, the Bonn International Center for Conversion, the University Institute of Lisbon (ISCTE), the Ethos Institute, the Graduate Institute of International and Development Studies (Geneva), and journals such as African Geopolitics, African Sociological Review and African Identity.

Abdoulaye DIOP, WAEMU Commission

On April 14, 2021, he was appointed President of the WAEMU Commission by the Conference of Heads of State and Government of the Union. Born in 1961 in Dakar, Abdoulaye Diop is Principal Inspector of the Treasury, certified by the National School of Administration and Magistracy (ENAM) of Senegal. He is also a former resident of the CERDI of the University of Auvergne in Clermont Ferrand in France from where he graduated Major of his promotion with the Diploma of High Studies in Management of Economic Policy in 1997, his subject of research focused on economic convergence policies within the framework of sub-regional integration (UEMOA). Economist, financier and public finance specialist, he was Minister in charge of the Budget from 2009 to 2012. Until April 2021, he was Minister, Advisor to the Presidency of the Republic of Senegal in charge of economic, financial and budgetary issues .

Notable authors in 2022

Stanislas ZÉZÉ, Bloomfield Investment Corporation

Chairman and CEO of Bloomfield Investment Corporation, Stanislas Zézé published in August 2022 his book entitled “the man with red socks”. Economist and businessman, the organizer of the annual “Risk-Country” Forum does not hide behind curtains and stylistic clauses. The tone is there from the start: “The process of writing “The Man with Red Socks” was personally significant and enlightening for me. This is the story of my small victories, my hopes and my difficulties. It’s also the story of who I really am, and I’m proud of it,” says the man who, beyond having launched the first rating agency of the African Economic and Monetary Union (UEMOA) in 2007, in same time as Wara, installed a life & style trend in the austere world of finance. A man of conviction, Stanislas is a “Mujahid” of work. “The success of a hard-working, serious, focused, persevering and resilient entrepreneur is not a matter of luck, but rather a matter of time,” he says in this self-published book. To these young Africans who dream of creating their own companies, these few words are intended. “Your project will not work Stan, it is too sophisticated as a project for Africa. These are the phrases I heard when I chose to be STAN ZÉZÉ”. Co-authored with the writer Pacome Kipré, this book is a sharing of experience. Stanislas Zézé looks back on the key events, errors and difficulties encountered. So many ordeals that made him what he has become.

Michel Lobé, “Being a billionaire in Africa today”

Author of the book “Being a billionaire in Africa today” (African Presence), Michel LOBÉ EWANÉ evokes the history of wealth in Africa, “as old as that of humanity”. “This story was written in particular by King Mansa Moussa who reigned at the beginning of the 14th century over the Mali Empire. He is considered the richest man of all time. His reign highlights how wealth and fortune are realities that have meaning, symbolism and history in Africa. Today, as more and more wealthy African businessmen and women reshape, transform and build the African continent by creating jobs, their image and legitimacy are often questionable. In “Being a billionaire in Africa today”, Michel Lobé Ewané chose to do them justice, through testimonies and surveys carried out with these personalities from the world of finance, mining, telecommunications and industry. Former editor-in-chief of the magazine Forbes Afrique, the Cameroonian journalist has had a long experience acquired in particular at the BBC in London where he worked for ten years, at TV5 Monde in Paris and at Mutations, a Cameroonian daily for which he was the Director General. Today managing director for Africa of the American financier Joseph Sassoon Group, he also serves as adviser to Sheikh Ahmed Bin Faisal Al Qassimi of Dubai.

Mohsen Abdel Fattah, co-author of the book “The Economics of Sport in Africa”

Prefaced by Makhtar Diop (SFI) and Rémy Rioux (AFD), Mohsen Abdel Fattah’s book calls on the most eminent specialists in sport and the economy in Africa, notably Fatma Samoura (FIFA), Tidjane Thiam (IOC), Vera Songwe (UNECA), Abdou Diop (Mazars), the legend Didier Drogba, the economists Andreff, Akindes, Ze Belinga, whose contributions offer analyzes and pragmatic and innovative solutions. A book co-edited by Michel Desbordes, professor of sports marketing at the University of Paris-Saclay and at EM Lyon Business School and the African Sports & Creative Institute. The book written by Abdel Fattah and the African Sports & Creative Institute and Michel Desbordes elaborates 16 key recommendations to get out of the picking economy by drawing inspiration from success stories known as the Senegalese wrestling.

THE FINTECH OF THE YEAR

Dare Okoudjou, MFS Africa

In 2022, the fintech MFS Africa founded by the Beninese Dare Okoudjou acquired for 34 million dollars (31.7 million euros), Global Technology Partners (GTP), a company of 63 people created in 2013 by the American Robert Merrick and domiciled in Tulsa, Oklahoma. With this acquisition, MFS Africa becomes one of the leading electronic payment players in Africa, having already supported GIMAC, the operator of the CEMAC zone and about to support GIM-UEMOA. Present in several African countries, MFS Africa operates the largest digital payments hub on the continent with more than 170 million mobile wallets in sub-Saharan Africa, providing unparalleled reach for financial service providers. According to the 2021 Mobile Money State of the Industry Report published by the GSMA (the international association representing the interests of over 750 mobile operators and manufacturers from 220 countries around the world), MFS Africa currently covers 60% of all mobile money wallets in the region.

Dina El Kadry, Alpha Digicredit

Dina El Kadry launched in 2020 the first mortgage intermediation platform in Senegal. Former director of real estate credit at the CBAO group Attijariwafa Bank, this finance and communication professional wants to facilitate the relationship, sometimes restrictive, between banks, real estate developers and candidates for acquisition. The Alpha platform, which has a mortgage intermediation authorization obtained from the financial authorities, has signed agreements with the largest banks in the market, which allows it to negotiate valuable rate reductions in favor of customers.

Elizabeth Rossiello, Aza Finance