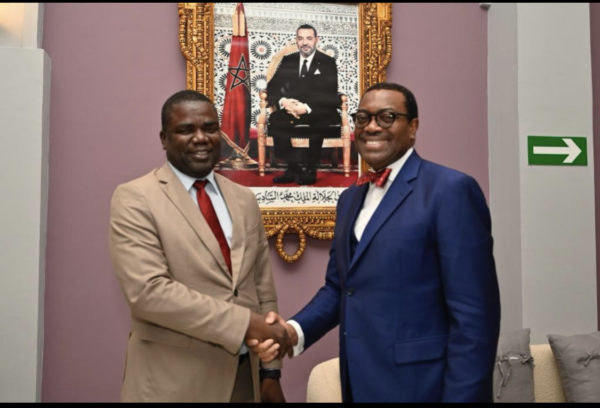

On the sidelines of the fourth edition of the Africa Investment Forum (AIF) held in Marrakech from November 8 to 10, 2023, Financial Afrik spoke with Akinwumi Adesina, the president of the African Development Bank (AfDB). It was an opportunity to take stock of these days dedicated to investment.

We have just concluded the fourth edition of the Africa Investment Forum. What should we take away from it? What is the contribution of the African private sector ?

After three days of meetings and negotiations, we recorded investment intentions of $34.82 billion, a phenomenal amount dedicated to infrastructure, energy, and agricultural projects, among others. In addition, the African Development Bank, the Islamic Development Bank, Afreximbank, UNIDO, and Arise launched the Agro-Industrial Zones Partnership (ZAP-A) for an additional investment of 3 billion dollars. The African private sector was well represented. Take, for instance, the Nador West Med industrial-port platform, a $4.5 billion project including a deep-water port, which generated a lot of interest in the AIF boardrooms. The same goes for the gas pipeline project between Morocco and Nigeria. The project to transform lithium into electric batteries in the Democratic Republic of Congo (DRC) also generated a lot of interest from investors. The same is true of the railway corridor linking Tanzania to Zambia, chaired in the boardroom by the President of Tanzania. I also followed the negotiations in the Togo boardroom with President Faure Gnassingbé for a railway project that generated a lot of interest. Beyond infrastructure, there was a lot of talk about agriculture and the transformation of African agricultural products. For example, rice in Sierra Leone with an $800 million project to cultivate 30,000 hectares of arable land and build a 90km road. In the presence of President Mada Bio, financiers showed a lot of interest in the project, and the AfDB will play a leading role in mobilizing funding for this strategic project.

You were particularly expected to address agricultural issues when you were elected president of the AfDB. Last year in Dakar, your leadership was decisive in concluding Compound 2. Here in Marrakech, there is this project for an alliance of specialized agricultural zones. What is its mission and scope ?

Africa produces a lot of commodities exported without added value. Africa accounts for only 2.6% of the added value in processed products globally. This ratio falls to 1%, Africa’s share in processed exports. By processing these products locally, we create jobs along the entire value chain. African jobs in industry represent only 6.8% globally compared to 90% for Asia. In short, we must ensure that everything produced is processed locally, thus creating added value throughout the textile, cocoa, coffee, cashew, cassava, etc. value chain. The same goes for livestock products, for example. Processing animal products in dedicated agro-industrial zones with a cold chain will increase their added value and create jobs. So, these specialized agro-industrial zones are new integrated spaces we have created to promote the processing of agricultural products. These ZAPs provide solutions in terms of infrastructure, energy, and facilities necessary for processing. These zones will transform our rural areas by creating jobs and prosperity. Benin offers a great example with the Glo-Djigbé Industrial Zone (GDIZ) dedicated to the local processing of agricultural products. Previously, Benin exported its cotton and cashew nuts without any processing. Today, the context has changed. All agricultural products undergo an initial processing before export. We must follow this example because I am convinced that exporting raw products leads to poverty. And exporting high-value-added products is the highway to prosperity.

The theme of this edition is significant: unlocking value chains. In this context, what about the issue of factor mobility such as eliminating visas between African countries and the energy essential for the transformation of agricultural products ?

Indeed, these two factors are significant. The African Union’s 2063 agenda, titled “The Africa We Want,” cannot be realized if people are not free. African economies cannot be integrated if their populations are not. How can one invest in a country if it’s difficult to get there? By eliminating barriers to the free movement of people, Africa gives itself the means to truly improve intra-African trade and investment. I applaud the historic decision recently made by Kenya’s President William Ruto to allow all African nationals to come to Kenya without a visa. Rwanda and Benin have also followed the same process. These three countries share strong growth and increased attractiveness to investors, especially Africans. Foreign Direct Investments (FDIs) are increasing, and so are tourism revenues. Thus, liberalizing and abolishing visas is beneficial.

Returning to the question of energy, it is a prerequisite for industrialization, which is among the top five priorities we have set at the African Development Bank (AfDB). When we began deploying our strategy, the electricity coverage in Africa was barely 32%. Today, it is at 57%. There is still much to do since over 600 million Africans still lack access to electricity. We are investing massively in energy production and high-tension lines. The 11 Sahel countries are part of our “Desert to Power Initiative,” aimed at making it the world’s largest solar energy zone, with 10,000 MW. It is a complex project encompassing production, transport (regional corridors), and upgrading of electricity companies. Examples include the solar power plants project in Segou (Mali), Mauritania, and Yellen (Burkina Faso). In Cape Verde, we are investing in wind power. We are supporting South Africa to resolve its energy crisis by investing in production and transmission with an amount of 400 million dollars.

Lastly, what do you think about the gas pipeline project connecting Nigeria and Morocco ?

You know, when the Russo-Ukrainian crisis broke out, Europe tried above all to secure its gas supplies. Africa must do the same. At AfDB, we dedicate 83% of our energy-related financing to renewables. But we are pragmatic. Renewables alone cannot solve the energy needs in the industrialization process. Africa must leverage its gas, and this pipeline project traversing several countries is a perfect example of cooperation and regional value chain. According to international energy agencies, if Africa utilized its gas for energy production, its share in polluting emissions would fall to 0.6%. This project has generated a lot of interest at the Africa Investment Forum (AIF).